Big business and shadowy tech giants are behind Gov. Hochul's proposal to lower car insurance premiums and reduce compensation to crash victims, betraying her claim that she's merely focused on "affordability."

The governor flagged her initiative in her State of the State address earlier this month, but the state's supposedly high car insurance rates have been on the agenda of Big Auto and tech libertarians for years.

Lately, it has been a crusade by an "Uber-led" group called Citizens for Affordable Rates (the acronym is, predictably, CAR), which has poured millions of dollars into ads and extensive lobbying in Albany to advance an insurance proposal that will end up harming New Yorkers who have been critically injured by drivers, advocates warn.

"As someone who has been injured in a traffic crash myself — and suffered the physical and financial consequences — I believe the best way to reduce car insurance rates is to reduce car crashes," said Kate Brockwehl, a co-chair of the advocacy group Families for Safe Streets. "That's why we need Albany to pass [legislation] to slow down the most reckless drivers on our streets."

Each year in New York, there are an average of 1,098 traffic deaths, 12,093 hospitalizations and 136,913 emergency department visits a year, according to the Department of Health. That breaks down to three deaths, 33 hospitalizations and 375 emergency visits every day.

Crashes are the leading cause of injury-related death in the state and they cost the state $33.6 billion in 2023, according to the research group TRIP.

The governor's plan to cut insurance premiums is partially built on reducing compensation to some of those victims by "tightening" the definition of "serious injury," a maneuver that advocates said will leave New Yorkers struck by drivers out to dry.

The Empire State has the second-highest insurance premiums in the country, after Florida, thanks the risks of its dense urban environments, especially around New York City.

The state also requires drivers to pay for comparatively higher coverage that covers people injured in crashes without having to go through lengthy litigation to determine who's at fault, also known as "no-fault" insurance.

But that could be changing.

Who is CAR?

CAR bills itself as a "coalition of concerned citizens, advocates, and organizations united in the fight for fair and equitable insurance rates."

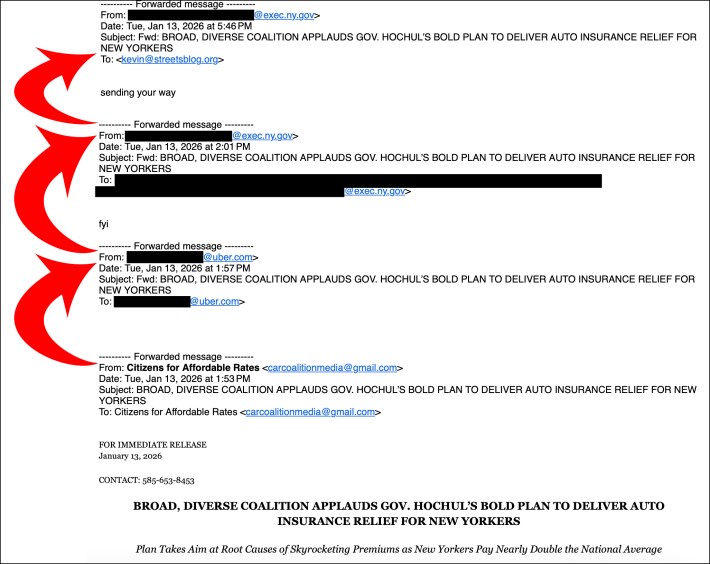

But only part of that is true. CAR is, first and foremost, a business group. And it's hiding in plain sight: When Streetsblog reached out to Gov. Hochul's office for comment on her State of the State proposal, a spokesperson merely answered our question by forwarding CAR talking points that had been forwarded to the governor's spokesperson from Uber's spokesman (names redacted below).

The group is an opaque limited liability company and boasted among its supporters Uber, Coach USA, Trucking Association of New York, the Black Car Fund, and local associations like the Urban League of Long Island and the Buffalo-Niagara chapter of the National Action Network. The Al-Sharpton-led National Action Network's main branch in New York City has not weighed in on the campaign yet, a spokesperson told Streetsblog.

The CAR website does not list people running it, and records of who registered the online domain are redacted. State records indicate the company being formed in Delaware in late 2024, and based in the Buffalo area.

CAR's supposed push for "affordability" should raise red flags given the big tech and auto-focused interests behind the move, said John Kaehny, executive director of the watchdog group Reinvent Albany.

"Uber’s priority is Uber," said Kaehny. "The basic equation here is whether or not drivers have to pay for the damage they do. That is an extremely high cost to society, and that cost should be internalized with the users, not subsidized by the taxpayers – that’s insane."

Late last week, a tech-friendly group called Chamber of Progress joined the fight on behalf of car owners by issuing a report on rising auto insurance costs that echoed statements by CAR and Hochul that New Yorkers are being "priced out."

Chamber of Progress has argued against making Google and Meta reimburse local newsrooms for profiting off their work, and also against extending the minimum wage to grocery app workers for apps like Instacart, as Streetsblog previously reported.

The group labels itself as a "center-left tech industry policy coalition" and is funded by tech giants like Uber, Lyft and food delivery apps. Its advisory board includes the state Senate's Transportation Committee Chair Jeremy Cooney (D–Rochester). Cooney has also been a booster of driverless cars, which Hochul also pushed in her State of the State.

Cooney declined to comment. Chamber of Progress, CAR and Uber did not respond for comment.

Big spending

CAR hired consultants Albany Strategic Advisors for 2025 and this year to lobby for insurance changes statewide, according to the state's Commission on Ethics and Lobbying in Government.

Uber gave the group "at least a million dollars," early last year, and the group also spent six figures on an ad campaign at SOMOS, the annual get-together of New York's politicos in Puerto Rico late last year. And in December, the group sent people dressed up as the Grinch to distribute fliers outside City Hall. Early this year, the organization dropped a cool $1 million for a television ad.

Citizens for Affordable Rates, a campaign to lower car insurance rates that’s sponsored by Uber, has folks dressed up as the Grinch flyering outside City Hall today.

— Jeff Coltin (@JCColtin) December 18, 2025

Sadly, the multi-colored flyers don’t explain who’s behind it. pic.twitter.com/RWpK1UU11X

The group's cause was also championed by the Partnership for New York City, the leading group for the city's business class, whose outgoing President Kathy Wylde gave a speech about rising auto insurance rates at an event hosted by City and State in October.

She also penned an opinion piece in the Daily News in December, arguing that New York's no-fault insurance regulation "encourages fraud," describing the compensation as an "easy payout" with "few questions asked." She did not provide evidence of fraud.

New York requires drivers take out "no fault" insurance, also known as Personal Injury Protection, to quickly cover medical costs and economic losses, regardless of who is at fault. It's one of 12 states that mandates no-fault coverage.

Follow the money

Uber's CEO Dara Khosrowshahi, meanwhile, donated $48,000 to Gov. Hochul's campaign and to the state Democratic party in the last four years – the only state political donations in his name, according to Board of Elections records.

And it's not just New York. Uber also backed a controversial law change in California last year to drop the required insurance for damage in crashes from $300,000 to $60,000, in exchange for giving ride-share drivers collective bargaining rights.

CAR also supported a controversial City Council bill from 2024 to slash no-fault insurance coverage requirements for cabbies from $200,000 to $50,000, which, similarly shifted the cost of crashes onto victims of road violence by dramatically cutting how much compensation victims get without having to sue.

The bill ended up becoming law last year, lowering the required coverage to $100,000. But that still cut in half the amount of compensation crash victims will immediately get to cover expenses without litigation. Since the previous requirement dates back to the 1990s, it's actually a 75-percent reduction adjusted for inflation.

Neither that recent deregulation nor Hochul's latest moves have the backing of the New York Taxi Workers Alliance, which has often fought app companies like Uber and Lyft on behalf of drivers.

The group's president came out strongly against cutting crash coverage, and declined to join Uber's group to avoid being "interfered with by corporate interests."

"We will vet any proposal to make sure that coverage isn’t cut — that has been our red line," NYTWA President Bhairavi Desai told Streetsblog.

Desai and the Taxi Workers Alliance are a key ally of Mayor Mamdani, who, counter-intuitively, supports Gov. Hochul's proposal, telling Streetsblog last week that high car insurance costs are "another way in which New Yorkers are being pushed out of the city." At the same time, he dismissed a reporter's assertion that lower insurance costs would encourage more driving and, therefore, more crashes, even though he has championed reducing both.

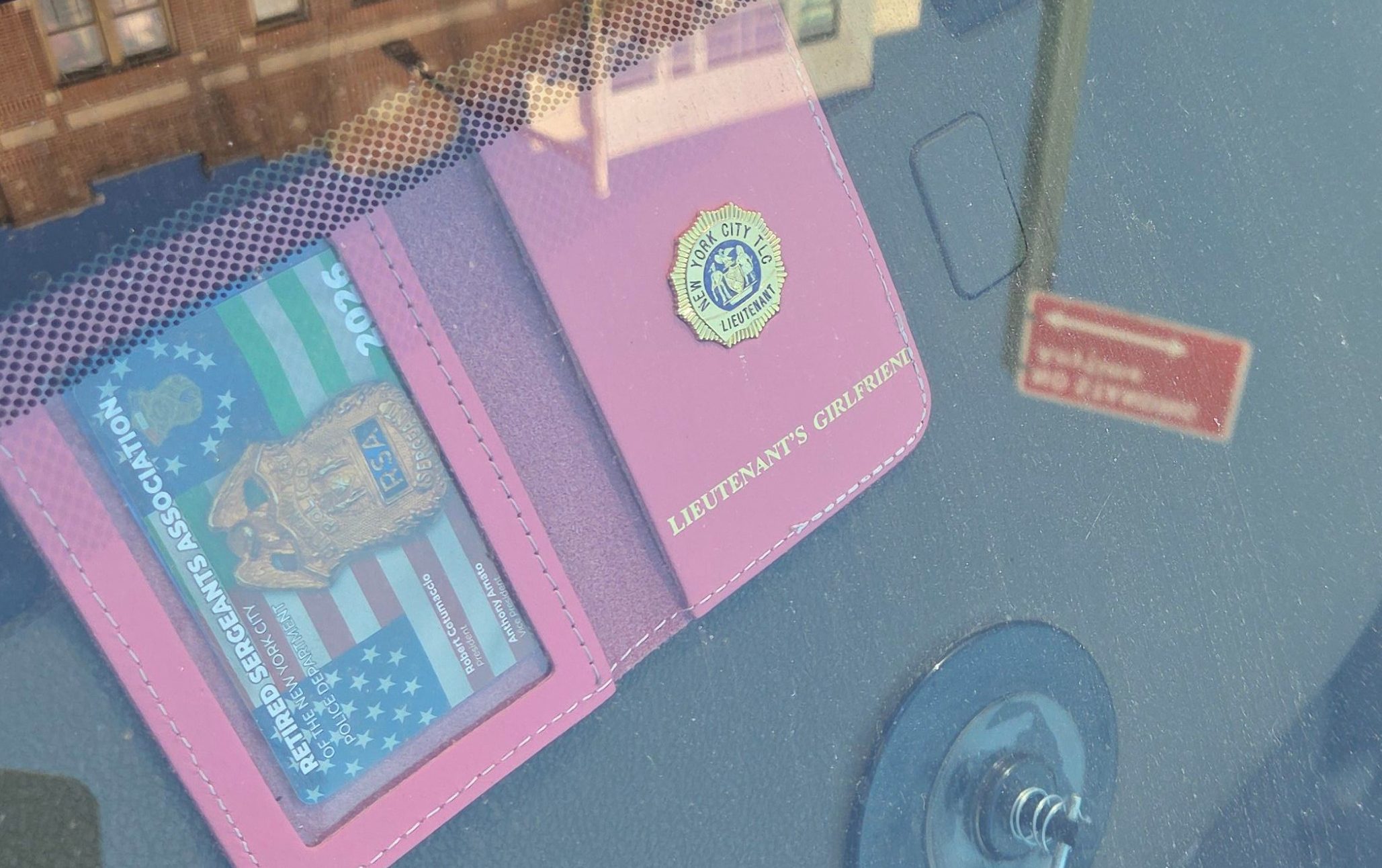

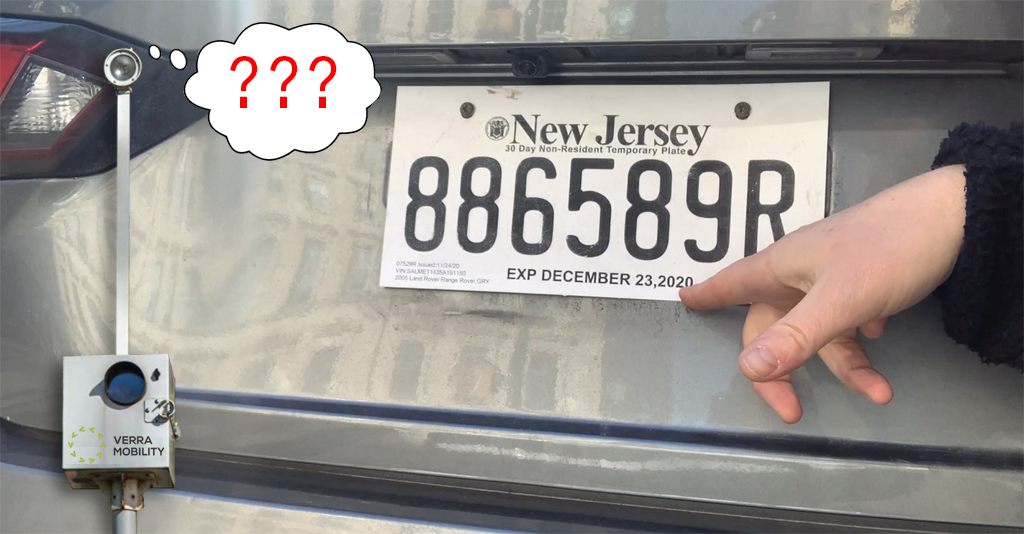

Rather than reduce compensation for seriously injured victims of car violence, the better way to lower insurance costs is to simply make streets safer by reining in recidivist speeders, drivers defrauding the state by using out-of-state plates, and ending corrupt practices like police courtesy cards, argued Richard Robbins, an Upper West Side consultant, in a recent op-ed.

But lawmakers are slow on the uptake: In 2022, for examples, Albany pols killed a bid to require insurance companies to be notified if their policyholders got five or more school-zone speeding tickets within a two-year period.

Albany responds

We asked Gov. Hochul's office to defend the governor's policy initiative as anything but the result of strong-arming by special interests. A spokesperson said that the governor puts safety first, citing Hochul's support for a stalled bill to install speed-limiting devices inside the cars on the most-excessive speeders, her work to pass Sammy's Law in 2024, and her backing the expansion of the city's speed- and red-light camera programs.

"Gov. Hochul is unwavering in her commitment to street safety in New York," said Sean Butler. "At the same time, the governor is committed to making New York more affordable, and any suggestion that she is acting on behalf of anybody other than the millions of New Yorkers, who today pay among the highest rates in the country is just wrong."

Wrong to Hochul, but not a high priority, perhaps, for the state legislature. On Wednesday, Assembly Speaker Carl Heastie told Streetsblog Empire State's Austin C. Jefferson that his chamber will indeed discuss the proposal — but it's going to be a heavy lift.

"I do agree that insurance rates are very high, but we have to figure this out, because I do think victims of accidents [sic] need to have their settlements, and their days in court," the top lawmaker said. "The government is trying to deal with a problem. But I also know that we don't want to leave victims of accidents without being compensated."

Assembly Speaker Carl Heastie is forecasting that updates to car insurance and the balancing act of bringing down car premiums and protecting crash victims will be one of the larger discussions in Albany this session pic.twitter.com/mBTFQDTtNq

— Austin C. Jefferson (@AJeffNY) January 21, 2026

Additional reporting by Austin C. Jefferson and J.K. Trotter