It could reduce driving statewide by more than eleven percent, put money in the pocket of two-thirds of the state's motorists and put little to no strain on the government budget. That sounds-too-good-to-be-true idea is called pay-as-you-drive insurance, and the city DOT is looking into how it might work in New York.

The idea is simple. Right now, most car insurance policies cost the same whether you drive 500 miles in a year or 50,000. While some of the costs of car-ownership change based on how you drive, like fuel or maintenance, insurance doesn't. If insurance premiums rose with every mile you drove, it would be one more incentive for drivers to keep the mileage down.

In fact, it would be a pretty hefty incentive, according to a 2008 Brookings Institution report on the subject [PDF]. They found that if all drivers paid for insurance by the mile, total driving would drop by eight percent. That's the equivalent of gas prices jumping by $1 per gallon, but in the form of a carrot, not a stick. In New York State, where insurance premiums are high, they estimated it could provide an 11.5 percent reduction in driving.

There's also a big market for pay-as-you-drive insurance. As you'd expect, those who drive more also tend to crash more and cost the insurance companies more. In essence, low-mileage drivers subsidize high-mileage drivers on average. With pay-as-you-drive, insurers could lure away the low-cost drivers with lower rates, a win-win for both those groups.

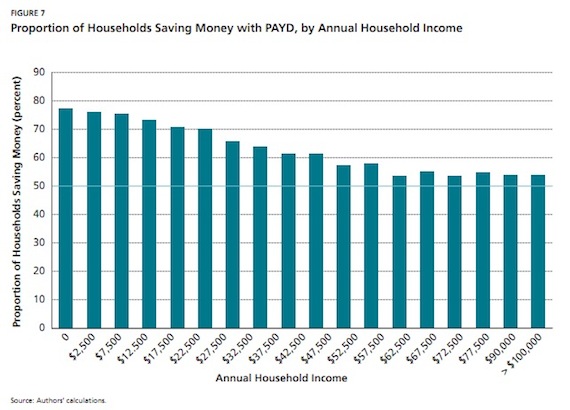

And because of the uneven distribution of miles driven, two-thirds of drivers nationwide would save money under a pay-as-you-drive system, according to the Brookings report. Since lower-income drivers tend to drive shorter distances already, the distributive effect of the policy is also progressive, according to Brookings.

So why isn't pay-as-you-drive already more popular? One reason is technology: in the past, it was difficult to accurately track how far people drove. With both electronic odometers that are harder to tamper with and GPS devices, however, measurement isn't a big obstacle anymore.

The other reason there isn't more pay-as-you-drive insurance, however, is the thicket of regulation surrounding car insurance, which makes pay-as-you-drive difficult to issue. It can run afoul of requirements that insurance costs be clearly stated before the time of purchase, for example. Conservative insurance commissioners may also shy away from such a fundamental change in how car insurance is priced. The Brookings report cited one New York State insurance regulator as saying that pay-as-you-drive would be inequitable, as upstate drivers would end up paying more while downstate drivers saved.

Thus while pay-as-you-drive is slowly starting to spread on its own -- in New York, Progressive insurance is the only company to offer it, according to the New York Post, though not in a pure form -- it'll take government action to clear a path for it. California's taken the lead on the issue, as Matthew Roth reported at Streetsblog San Francisco, and Massachusetts just announced it was going to push pay-as-you-drive as part of a major climate initiative. Now New York City wants to join them.

So far, DOT has just put out a request for expression of interest in the idea [PDF], a very preliminary step in any process. It's looking for information about what barriers currently stand in the way of pay-as-you-drive in New York, what it would take to make a program successful, and different ways the data might be collected.

One unanswered question, though, is what power the city has over the issue in the first place. Auto insurance is regulated at the state level. DOT wouldn't answer any questions on the issue, however.

We also have a call in with the state Insurance Department to see what regulations currently govern pay-as-you-drive insurance.