Citi Bike lives!

Lyft and Citigroup announced a new sponsorship deal on Friday that will keep the bank giant’s name on blue bike-share bikes in New York City.

The deal is good news, with Citigroup continuing to underwrite some of Citi Bikes costs through 2034, according to the New York Times, which first reported the story. In the immediate term, the money will help New York will avoid the fate of Minnesota’s Twin Cities, whose 12-year-old bike-share system was killed overnight when the local sponsor pulled out.

Still, Lyft, which bought Citi Bike operator Motivate for $250 million in 2018, is undergoing a period of change. The California tech company replaced its longtime chief executive in April and laid off 26 percent of its workforce a few weeks later. The extent of the damage to the bike-share product remains to be seen, though Lyft insists it is minimal: overall worker hours for bikes mechanic and delivery drivers are up this year, a rep said, and the company is hiring up for the spring and summer as it does every year to meet demand that only seems to be increasing.

One problem: bike-share is not big business for Lyft. If New Yorkers and New York officials want bike-share as a widely available public service unwedded to profit or corporate branding or a system that expands beyond the limits of the current sponsorship, the city and Lyft are going to need to do more.

The public-private conundrum

Lyft’s main product is for-hire car trips. That was apparent in new CEO David Risher’s single mention of bike-share during the company’s most recent earnings call. Risher seemed to suggest that the main value of bike-share for Lyft is that it can attract more customers to the company's car-related services.

“E-bikes are a big deal. When people ride e-bikes they like them a lot,” he told investors. “But for us, we haven't done the job we need to do to make sure that every time a person rides the bike, they get welcomed into the Lyft ecosystem, and frankly, welcome into the ride-share side of things.”

Citi Bike turns 10 years old tomorrow, May 27. In its decade of existence, the bike-share has shown larger growth than any others bike-share system in North America or Europe, carrying an average of 91,419 trips per day last month, according to publicly available stats. But it’s a blip in Lyft’s bottom-line.

“I think if you polled folks, 'What could Lyft do to get more profitable?' I would imagine a lot of folks would probably put slimming down their micro-mobility business as one of the more likely options,” said investment analyst Tom White of D.A. Davidson Company.

"Generally speaking, I think investor sentiment on some of the micro-mobility stuff is not very positive at the moment. The results and financial performance of the business hasn’t looked anything like what the original pitch was.”

Lyft’s bike-share operation, currently in eight metro areas, isn’t a big money maker or loser for the company, White said. Risher may opt to keep the bike product if he decides it complements Lyft’s “core” ride-share product — he could also decide the capital investment in bikes isn’t worth the return on investment.

In a statement, company spokesman Jordan Levine said, "Citi Bike is one of the most successful public-private partnerships in the world — on track to complete the largest service area expansion in the program’s history — which is why it remains an important part of Lyft, as the company builds a stronger and healthier ride-share business.

“Bike-share systems like Citi Bike address so many transportation and sustainability challenges that are core to Lyft’s mission, and the changes we have made were designed so we can continue to meet the needs of our micro-mobility riders and city partners," the statement added.

Investors have been pushing Lyft and its larger competitor Uber to show they can make profit, according to reports. For Uber, that meant off-loading its bike-share outfit, Jump, in 2020 and investing growth internationally and in food delivery. (Lyft doesn’t do food delivery.)

Citi Bike has survived several changes of ownership, with Lyft’s purchase of Motivate just the most recent. The bike-share was originally run by a Portland-based company, which a group of New York City investors purchased, renamed and moved to the Big Apple.

“Lyft has assured us Citi Bike is a priority,” Department of Transportation spokesman Vin Barone said in a statement. “We always work to be prepared for any scenario and have strong protections baked into our contract with Lyft to protect New Yorkers’ access to public bike share.”

So what's the city to do?

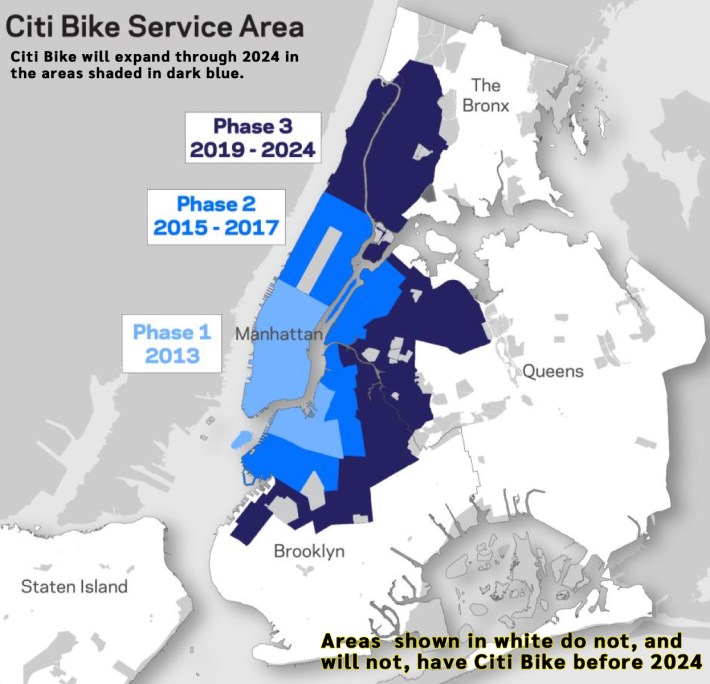

The uncertainty in Silicon Valley briefly sidelined another important Citi Bike discussion — what's next? There's no roadmap beyond the deal announced in 2019 to expand Citi Bike into the Bronx, Queens and Brooklyn, and increase the fleet from 12,000 to 40,000 bikes. That expansion and infill wraps up in 2024. After that? There is no plan.

Mayor Adams campaigned in 2021 on a pledge to "expand Citi Bike well beyond more affluent communities by committing city funding." Citi's sponsorship covers about 10 percent of bike-share's revenue, according to public data, but its expenses are not public so the exact context of that contribution is unclear.

What's undisputed is that Citi Bike operates almost entirely without government funding. Lyft pays for the bikes, the stations and the right to use the curb, as well as the back-end software that keeps Citi Bike operating. DOT's role is limited to siting stations and crafting the terms of the overall program.

That makes New York an outlier in terms of cities outside of China with large bike-share systems, a Lyft spokesman said. Public funding allows municipalities to dictate the terms of bike-share, even when they may not be favorable to Lyft’s profit-making imperatives. In the D.C. region, for example, municipalities fund both stations and bikes — allowing them to dictate service regardless of demand, the rep said.

The funding trickles down to D.C. area bike-share riders, for whom membership is just $95 — compared to Citi Bike’s $205 annual membership. An e-bike ride in New York is $0.17 per minute for bike-share members; in D.C., it's just $0.10 per minute.

A tentative agreement approved in February in San Fransisco, meanwhile, would put $16 million of public funding into the expansion of the Bay Wheels system. Lyft in turn lowered membership costs including for e-bikes.

New York City officials may be reluctant to pursue a similar agreement, but they might not have a choice if they want more discounted pricing for low-income New Yorkers, as DOT Commissioner Ydanis Rodriguez suggested back when he was a council member, or to go deeper into neighborhoods beyond the existing Citi Bike core zone, such as Bay Ridge, where politicians say they are eager to get on the bike-share map:

Ya gotta love @CitiBikeNYC systematically icing out the "outer" borough transit deserts. The map doesn't lie. Now that all the bougie transit rich neighborhoods have their docks, Citi Bike says they're broke. No further expansion without city subsidy. How convenient!👎🏼 pic.twitter.com/W604QngjHm

— Justin Brannan (@JustinBrannan) November 30, 2022

The economics of bike-share for Lyft remain obscured. The company has struggled since the onset of the Covid-19 pandemic, which led to fewer managers on the operations side, according to organized labor. Record-breaking demand since 2020 has actually required more workers to maintain and move bikes around cities. This year unseasonably warm weather required Lyft to pay out 40 percent more hours of wages to maintenance workers and drivers compared to 2022, according to the company.

Labor pains

“They were looking to cut corners and save a little money, but they couldn't because in the end they needed more workers because ridership was growing,” said TWU Local 320 President Patrice Delva, a D.C.-based bike mechanic whose union represents bike-share workers employed by a portion of Motivate the company did not purchase back in 2018.

The tension between the need to hire-up to meet demand and downsize to satisfy investors reflects the tension inherent in operating any public amenity as a profit-making enterprise, but is especially acute with Citi Bike, the union leader said.

"The for-profit model of bike-share doesn’t make sense. Bike-share is a transportation and a community-building enterprise. It helps your city function better, it gives people options, it reduces traffic. It makes your city more livable,” Delva said.

“If Lyft wants to be a part of that, then it needs to be for not to make money but other reasons. … All those things are really positive, but they're not going to make you a lot of money.”

The corporate management questions come as Citi Bike faces New York-specific growing pains that observers believe will require the attention of city officials. Lyft issued an apology for less-than-stellar service last summer as it worked to meet soaring demand for bikes and docking stations. Riders complain anecdotally about declining quality of bikes and difficulty finding docks to leave them.

@CitiBikeNYC as usual, no docks. You need to remove 80% of the bikes in this neighborhood every day. pic.twitter.com/or8dkG2IGX

— DHGNYC (@_doug_glass_) May 12, 2023

The data Lyft provides to the city each months shows the company meeting its monthly quotas for both, though Lyft has not provided its rebalancing rate since the end of 2020. Lyft said it “has worked with DOT to focus on other metrics … to ensure that the system is reliable around the clock.”

On Tuesday, a group of Manhattan elected officials led by Council Member Erik Bottcher called for a “comprehensive audit” of Citi Bike, citing concerns about e-bike and dock availability.

“We have recently received an uptick in reports from our constituents who rely on the Citi Bike program and have been left feeling dissatisfied with the level of service they have received,” the officials said.

“Far too often, we find that entire neighborhoods have difficulty using your service during peak hours because the racks are unbalanced; they are either all empty, or all full. In many neighborhoods, it is not uncommon for all the docking stations to be full, forcing people to leave their neighborhood to dock their bikes.”

May ridership is up 30 percent this year compared to 2022, Lyft said in response to the letter. Hells Kitchen in Bottcher's district sees more than double the number of Citi Bike riders per dock as the rest of the city, with most trips going out of the neighborhood and not in.

"We are using all the levers at our disposal to ensure there are bikes available in our highest utilization neighborhood at the end of the morning rush hour — and the early results have been promising," Lyft Vice President for Transit, Bike and Scooter Policy Caroline Samponaro said. "Meanwhile, we continue to closely partner with the city on exploring longer-term structural improvements, including electrification of stations."

Citi Bike’s current contract with the city limits the number of e-bikes to just 20 percent of its fleet — another key question for city officials as they negotiate the program’s next steps.

Lyft also wants its stations connected to the electrical grid, which would cut the time- and fuel-consuming process of swapping out dead batteries by 90 percent. It would also be a candidate for federal funding courtesy of the Biden administration's "Inflation Reduction Act" efforts to expand the country's electric charging capacity.

With all that on the agenda, it's time for the city and Lyft to nail down an expansion deal, according to advocates.

"Citywide expansion of Citi Bike is long overdue. To meet our climate goals and reduce car dependency, we need to give New Yorkers affordable and reliable transportation options," said Elizabeth Adams, deputy director at Transportation Alternatives.

"It’s time for our elected leaders to fund bike share — like they do every other transportation system in the city — to keep down prices and to ensure the system is expanded to every neighborhood in every borough."