Black and Latino workers will foot a disproportionate share of a recent MTA-saving payroll tax increase thanks to Albany's capitulation to suburban legislators in budget negotiations last month, according to new findings.

The exemption of suburban business from the small tax hike means Black, Hispanic and Asian employees of city-based companies will shoulder an unequal share of the increase, which helped save the MTA from fiscal ruin, the Fiscal Policy Institute found in its analysis of the final budget.

"It's a big shift in the tax burden that shows how the current state legislature is not really focused on equity along sort of racial and economic lines," FPI researcher Emily Eisner told Streetsblog.

Gov. Hochul and the state legislature agreed in late April to raise the payroll mobility tax — a levy on businesses in the 12-county MTA region — as part of the plan to fill the MTA's billion-dollar fiscal hole. Hochul had initially proposed to raise the tax on every business with a quarterly payroll above $437,500 — which is the highest threshold for the tax — but a revolt by suburban legislators on Long Island and in the Hudson Valley led to the hike exclusively affecting New York City businesses in that high tax bracket.

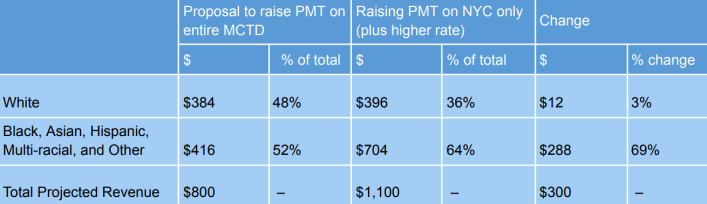

"By exempting suburbs from the PMT increase, there will be a 25-percent decline in the share of white workers impacted by the tax, and a 36-percent increase in the share of Black workers impacted by the increase," wrote Eisner and co-researcher Andrew Perry, citing a 2021 Congressional Budget Office report that found that about half the cost of payroll taxes typically get passed onto workers.

"Overall, there will be a 23-percent increase in the share of non-white workers impacted by this tax increase."

Those workers will pay almost $300 million more in taxes when compared to Hochul's original proposal partly because of demographics (New York City's workforce is only 36 percent white, while the suburban workforce is 61 percent white), and partly because of politics, according to the analysis. Exempting the suburbs from the hike required lawmakers to impose a higher increase on the city to raise the money needed to close the MTA's fiscal gap.

One state legislator who spent budget season pushing for an MTA rescue plan said that the final result put the interests of the suburbs ahead of those of the entire region.

"It's outrageous because this illustrates the consequences of fiscal policy that privileges the suburbs over the larger MTA region," said Assembly Member Zohran Mamdani (D-Astoria).

"We need to fund the MTA through a recognition of all the value it creates, and the fact is that it's not just a New York City entity. This is a matter of fairness and good economic policy, and if we don't focus on that we see the consequences include a racialized disparity on who has to bear the burden."

Suburban politicians led by state senators from Hudson Valley and Long Island argued during this year's budget process that the regional transit authority's finances the city's problem, because their constituents don't use the subway. But Hochul's proposal would have required the suburbs pay about $200 million of the $800 million of the overall increase — commensurate with the 25-percent share of MTA funding that goes to the LIRR and Metro-North, according to FPI.

To boot, both commuter railroads set pandemic-era ridership records for two consecutive weeks — suggesting that people in the suburbs do rely on the MTA, and ought to shoulder some of the cost of keeping it running.

"We saw arguments somewhat frequently in the press that it would be unfair to raise the payroll tax in the suburban counties in the MTA region, because they think of themselves as not using the city component of the MTA day-to-day, and it was continually characterized a really a city issue," said FPI Executive Director Nathan Gusdorf.

"So we just wanted to reiterate the point that, in addition to that being an unfair distribution of costs, it's also very racially inequitable to build in this exemption."

Few legislators were willing to speak out against the suburban exemption during budget negotiations, with Assembly Member Robert Carroll (D-Brooklyn) one rare exception.

A spokesperson for the Senate Democrats did not respond to a request for comment, while Gov. Hochul stood by the major piece of the MTA rescue plan.

"Gov. Hochul took bold action to save the MTA from a looming fiscal cliff by changing the payroll tax rate paid by the biggest corporations in New York — a move that will generate much-needed revenue that will help New Yorkers who rely on public transit," said Hochul spokesperson Avi Small.