New York has been a step ahead of most states in recognizing and tackling the systemic racism that prompts auto insurers to charge Black drivers with good records more than white drivers with bad ones — but its insurance regulations may not do enough to solve the problem, consumer advocates say.

That’s because state law still allows certain factors — especially credit history — to be used in setting rates.

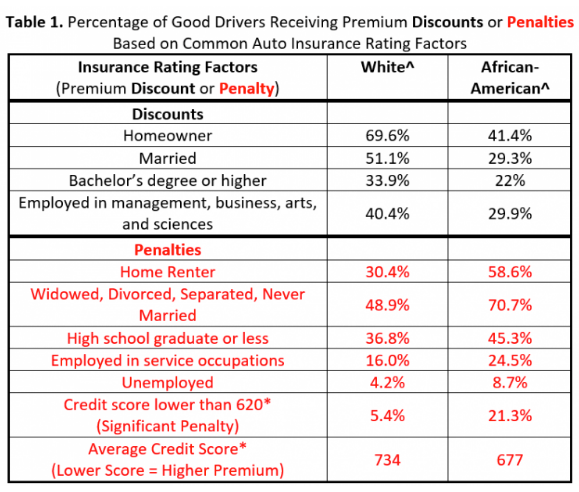

Credit history “correlates closely with race and ethnicity because of the legacy of institutional racism” and thus unfairly disadvantages Blacks seeking auto insurance, explained Douglas Heller, an insurance expert at the Consumer Federation of America. Other such discriminatory factors are renting versus owning a home and ZIP code — both close proxies for race — because black communities historically bore the burden of redlining, a long-illegal practice that denied Blacks home loans or charged them more for credit.

“You have to take a look at all factors and pull out those that disproportionately affect people of color. Otherwise, you play ‘whack-a-mole,’” Heller said. The most predictive and least discriminatory factors insurers can use in setting rates are — surprise! — an individual’s actual safety record and number of miles driven, because a driver who is on the road less obviously has fewer opportunities to crash, Heller added.

State insurance practices are coming under scrutiny as the Black Lives Matter movement spurs the state-regulated auto-insurance industry to acknowledge its decades-long discrimination against Black drivers — a long overdue reckoning for a business with an ugly history.

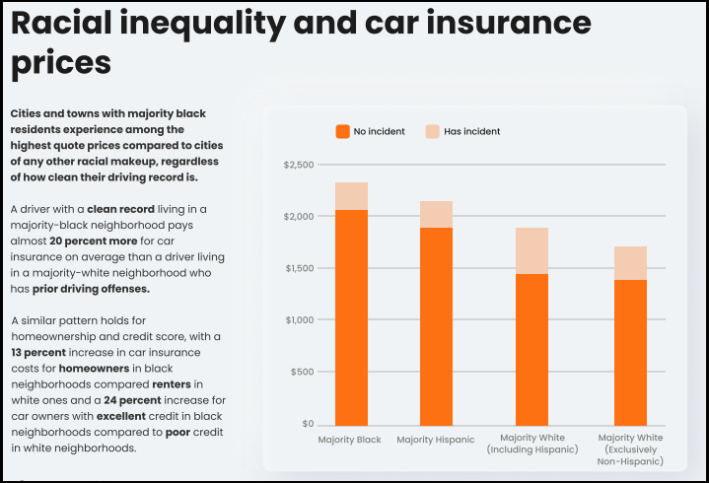

”Cities and towns with majority Black residents experience among the highest quote prices compared to cities of any other racial makeup, regardless of how clean their driving record is,” states a new report from Insurify, a major “virtual insurance” agent and industry trend-tracker. “A driver with a clean record living in a majority-Black neighborhood pays almost 20 percent more for car insurance on average than a driver living in a majority-White neighborhood who has prior driving offenses.”

As the report tells it, the insurance industry practices a form of “redlining” — although it doesn’t use the term: “A similar pattern holds for homeownership and credit score, with a 13-percent increase in car insurance costs for homeowners in Black neighborhoods compared renters in White ones and a 24-percent increase for car owners with excellent credit in Black neighborhoods compared to poor credit in White neighborhoods,” the report says.

The report, “Insuring the American Driver: Trends in Costs and Coverage,” follows a number of legislative and institutional developments aimed at undoing racist insurance practices.

Last year, Michigan Rep. Rashida Tlaib, Queens Rep. Alexandria Ocasio-Cortez, and some other Democratic lawmakers introduced legislation that would enjoin the industry from using consumer-credit data in setting set auto-insurance rates.

"Auto insurance rates should be determined by your driving record, not your credit score, gender, marital status, education, residence, or any other non-driving factor that has nothing to do with your safety on the roads," Tlaib said in a statement.

In July, the National Association of Insurance Commissioners — which brings together the nation’s chief insurance regulators — announced that it was establishing a committee to address practices that promote racially discriminatory outcomes.

“The needless deaths of Ahmaud Arbery, Breonna Taylor and George Floyd have led to a movement on racial equality, that we cannot ignore,” Ray Farmer, the NAIC president, said at a special session on race and insurance in August.

Of course, civil-rights groups such as the NAACP have fought discrimination in the insurance industry — and in auto insurance in particular — for decades. Investigative reports also have exposed the auto-insurance industry’s racist practices for years.

New York, along with California and Massachusetts, has been among the more proactive states in the union in trying to amend the practices that enshrine institutional racism in insurance.

In 2017, New York’s Department of Financial Services forbade insurers from taking education and occupational status — two factors that disproportionately disadvantage Black drivers — into account when writing auto-insurance policies "unless the insurer demonstrates ... that its use of occupational status and/or educational level attained ... does not result in rates that are excessive, inadequate, or unfairly discriminatory." The department patted itself on the back when it got the state’s major insurers to agree to comply with the rule.

The department declined to release any statistics about discriminatory insurance rates without a Freedom of Information Law request. It said that it is aware of the issues associated with the use of credit scores, but noted that state law authorizes their use. State rules encourage insurers to rely more on the actual driving habits of insured individuals in writing policies, according to information the department provided.

An Insurify data scientist, Kacie Saxer-Taulbee, said that companies’ business practices perpetuate and even worsen racial disparities.

“These price disparities may be unintentional, but they are nonetheless structural,” she said. “Insurance companies’ machine-learning algorithms … have worked to exacerbate, not democratize, racial disparities in insurance quoting.”

But the industry understands that it must address its structural racism, she said.

“The conversation on racism in the insurance industry has been brought to the public’s attention, and insurance companies are looking to move forward in this age of corporate responsibility,” she said. “That said, it is still too early to know what substantive changes may result.”

Heller of the CFA said that state regulators have their work cut out for them. “For the most part, states just let insurance companies do whatever they want,” he said. “Regulators are extremely deferential to the industry.”

Insurify’s report analyzed data from 25.5 million car-insurance premiums from all 50 states.