People with widely varying views on congestion pricing share the worry that drivers will inundate the subways when the congestion charge takes effect. The trains are laboring to handle today’s volumes, the thinking goes. How, then, will they accommodate the commuters whose auto trips will be "priced off the roads" when bridges and streets leading into the heart of Manhattan are finally tolled?

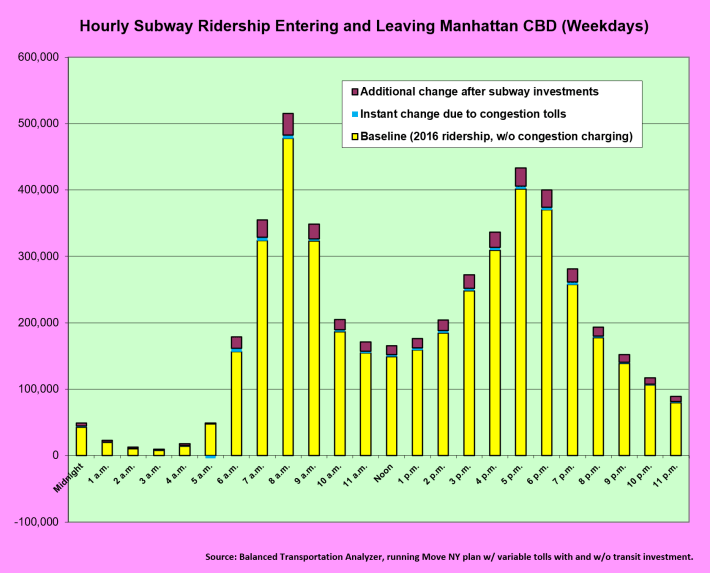

It’s a resonant argument, and one I may have had a minor hand in propagating. When my BTA spreadsheet is asked to model the variable-tolling version of the Move NY toll reform plan, it computes 7 percent increases in subway ridership in both the morning and evening rush, or about 30,000 additional riders per peak hour.

That’s a lot of passengers. Where can they possibly fit? Or, as TransitCenter tweeted last week:

NYC subway ridership was 12% higher in 2016 than when Bloomberg launched his push for congestion pricing - the margins for adding riders without new capacity & much better service are slim https://t.co/PP3PLMho9W

— TransitCenter (@TransitCenter) December 29, 2017

With Governor Cuomo expected to formally propose a congestion pricing plan in his state of the state address tomorrow, I took a fresh look at the BTA’s subway use projections. This time I ran the numbers with just the “stick” of tolling auto trips off the roads -- that is, without the “carrot” of additional trips the subways will attract once the MTA has overhauled and modernized signals, tracks, and communications.

The projected increase in subway ridership in this "overnight" scenario differs from the increase in the longer-term scenario, like night from day. The gain in subway ridership shrinks to a sixth of the figures above: to just 5,300 in the morning peak hour and 4,300 in the evening peak. Each increment is just 1.1 percent of current ridership in the same hours, and far less than variations in subway usage experienced from one day to the next.

How can this be? How could such a momentous change as congestion pricing trigger only a relative trickle in subway use? There are several reasons.

First, right now, without congestion pricing, five times as many people are entering the Manhattan central business district each weekday by subway as by “untolled” automobile or truck -- 2,159,000 vs. 414,000. (The latter figure counts auto passengers along with drivers but excludes vehicles that enter the CBD via the tolled Hudson and East River tunnels and thus won’t face further tolls. It excludes as well the estimated 21 percent of vehicle trips that pass through the CBD and thus are unlikely to switch to a subway.)

Because of this 5-to-1 ratio, even if every vehicle being dinged with the congestion charge switched to a subway, the number of straphangers would rise by only 20 percent.

Second, while congestion pricing achieves a significant reduction in gridlock, it does so by shifting a relatively small share of cordon-crossing vehicles off the streets. The BTA puts the toll-caused decline in CBD-bound car and truck trips at around 60,000 — or 10 percent of the current base of 608,000. The attrition in the morning peak period will be less because most trips at that time are work-related, making them less sensitive to the price jolt from the congestion charge.

Last, car trips to the CBD are less concentrated in peak periods than are subway trips. The 8-9 a.m. hour accounts for just 6 percent of total daily car and truck trips to the CBD, compared to 11 percent for subways. While the latter figure underscores the intensity of rush-hour crowding on the trains, the nearly two-to-one ratio further attenuates the impact of the subway influx from car trips priced off the roads.

Multiply those three factors — the current 1-to-5 ratio of untolled cars to subway riders, the 1-of-10 share of car trips predicted to be priced off the roads, and the roughly 1-to-2 ratio of peak-hour car to peak-hour subway shares — and you literally get 1 to 100: the 1 percent immediate bump predicted for subway use from congestion pricing.

(This is just a skeletal overview. The BTA works with actual numbers, not ratios; it also captures subtleties such as car passengers, who will add to the subway influx; and those toll-averse drivers who will seek non-CBD destinations or use non-subway commute modes, who will detract from it. But it conveys the gist.)

This is not an argument against adding transit capacity during the run-up to congestion pricing. Quite the opposite. Intuition dies hard, and the “optics” of congestion pricing require that transit and transportation providers step up with the kinds of tangible enhancements to trains, buses, and bikeways that TransitCenter outlined last week. Moreover, the watchword during the countdown shouldn’t be to just scrape by but to offer New Yorkers quantum improvements in commuting time and experience.

And bear in mind that we’re going to need expanded transit provision to fully accomplish congestion pricing’s mission of converting large numbers of car trips to non-automobile modes. When the carrot of transit investment is programmed back into the BTA, it calculates that for each 100 auto trips that stand to be disappeared more or less immediately by the price stick, another 45 to 50 will be eliminated over time as the better-transit carrot kicks in.

Let’s not leave those car trips on the table ... or on our streets.