The MTA capital program is facing a $12 billion shortfall, according to Comptroller Thomas DiNapoli, and unless that gap is closed, transit riders will end up paying even more to cover the agency's ballooning debt load. There's one clear way to address that problem while cleaning up the traffic mess that ensnares motorists, bus riders, pedestrians, and cyclists alike -- raising revenue by reforming NYC's broken toll system. But a leader of Governor Cuomo's MTA Reinvention Commission appears to favor a regressive option that won't fix the dysfunction on city streets.

Capital New York's Dana Rubinstein reported yesterday that Ray LaHood, former U.S. secretary of transportation and co-chair of the commission, thinks Virginia's transportation funding model is worth considering in New York. "They went from a gas tax to a sales tax," LaHood told Capital. (Virginia repealed its gas tax in favor of a wholesale tax paid by gas station owners and a sales tax increase paid by consumers, raising $880 million each year.)

Speaking to Brian Lehrer on WNYC this morning, LaHood said he was unfamiliar with the "Fair Plan" promoted by "Gridlock" Sam Schwartz and the non-profit Move NY, which would raise revenue for transit by creating a more rational citywide toll system. LaHood went on to say, "People think [the Virginia sales tax model] has great potential."

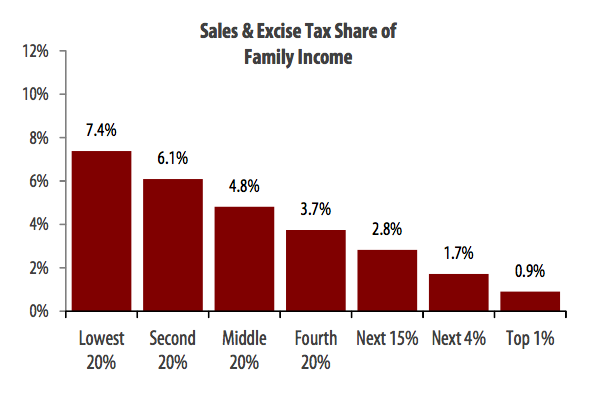

But a sales tax is one of the most regressive revenue-raisers out there. Of the types of taxes states typically levy -- on property, income, and sales -- "sales and excise taxes are the most regressive, with poor families paying eight times more of their income in these taxes than wealthy families, and middle income families paying five times more," according to the non-partisan Institute on Taxation and Economic Policy [PDF]. In New York, sales taxes already hit the poorest fifth of the state's households more than twice as hard as the wealthiest fifth, when measured as a percentage of income [PDF].

Compare that to who would pay under the Move NY toll reform plan: Tolls would increase only for people driving to Manhattan south of 60th Street, while tolls would drop on outer borough crossings. Car owners are wealthier than car-free New Yorkers, and a Move NY analysis shows that drivers who will pay more under the plan have household incomes far higher than transit users. Asking them to pay a higher toll to support train and bus service, while lowering tolls in the outer boroughs, transfers resources from the haves to the have-nots -- it isn't regressive at all.

Is a sales tax the only politically viable option? Not if Governor Cuomo decided to support toll reform. Congestion pricing, after all, passed the City Council and enjoyed good polling numbers when it was linked to affordable transit fares. Tolling the East River and Harlem River bridges came within a handful of votes of passing the state legislature in 2009 -- three of the four state senators who blocked it are no longer in office.

The Move NY plan, meanwhile, has the added carrot of toll reduction on outer-borough crossings and is polling better than congestion pricing. City Hall is open to the idea, and the speaker of the City Council, Melissa Mark-Viverito, is one of the most vocal political supporters of road pricing on record. So is her deputy in the council, Brad Lander.

"I don’t know that it’s radioactive," said Gene Russianoff of NYPIRG's Straphangers Campaign. "We’re in different times than 2007."

The Move NY plan would raise an estimated $1.4 billion annually. Transportation economist Charles Komanoff, who crunched the numbers for Move NY, says that raising the same amount through the sales tax would require a hike of approximately 0.7 percentage points in the entire 12-county MTA region. The Move NY plan only affects crossings entirely within the five boroughs. Komanoff estimates that restricting a tax hike to New York City would increase the city's sales tax by 1.2 percentage points, from today's 8.875 percent to over 10 percent.

"The sales tax is the most regressive of all major tax instruments," Komanoff said. "If you wanted to destroy New York City's economy and its communities, you couldn't pick a better policy than rejecting the Move NY plan and hiking the sales tax instead."

Sales taxes already fund a small portion of the MTA's budget, which relies primarily on tolls, fares, and taxes on payroll, real estate transactions, and petroleum, among other things. Tweaking that formula could be up for consideration in Albany later this year, and members of the reinvention commission say they are examining all revenue options before issuing their recommendations in September.

"It has to be a combination of several mechanisms, and I don’t know what the best combination will be," said Tri-State Transportation Campaign executive director Veronica Vanterpool, adding that tolls for driving to Manhattan is a "key funding mechanism" because of the larger benefits it creates, like encouraging transit use.

Road pricing offers other benefits a sales tax can't duplicate. “With bridge tolls comes a reduction in congestion and a lowering of shipping costs and a more rational use of our highways and less pollution," Russianoff said. "But with a sales tax, generally what it does is makes people without a lot of money agonize over whether they can buy a winter coat for their kids.”