Wondering how the revised version of the Ravitch plan compares to what's come before? Here's a look at the tweaks proposed yesterday by the Ravitch Commission:

- East and Harlem River bridge tolls of $2.16 each way with EZ Pass, $2.50 without.

- 50-cent taxi fare surcharge.

- A higher tax rate on parking in Manhattan.

- Revenue from (2) and (3), an estimated $150 million, to fund “toll mitigation rebates,” with details decided by a new commission to be established by the legislature.

- (Unchanged: a regional payroll tax of 33 cents on each $100 of earnings.)

I figure the net take from the tolls at around $600 million,

or a few hundred million less than from the original Ravitch

proposal of $5 East River and $2 Harlem

River tolls. The higher tax on lots

and garages portends more cruising for parking, and, what's worse, that new Toll

Mitigation Entitlement Commission would establish a bad precedent: bureaucrat-approved rebates for "deserving" bridge commuters.

It’s tempting to lay the blame for these moves on Albany, particularly the handful of senators who torpedoed the original Ravitch tolls and their colleagues who then backed away from the heart of the transit rescue package: the payroll tax being counted on to generate $1.6-$1.7 billion a year for the MTA. But in the past month, the Ravitch Commission has taken a pass on two proposed amendments that just might make its plan politically palatable.

One is to modulate the payroll tax rate so that the suburbs pay less. A source close to the Ravitch Commission estimates that lowering the tax rate to 22 cents per $100 for businesses in Nassau and Westchester and to 11 cents for the five exurban MTA counties (Suffolk,

Putnam, Rockland, Orange and Dutchess) would reduce the tax revenues by just 13%, or $215 million.

That’s a giveback that wavering lawmakers could sell as a win but that doesn’t torpedo the plan as a whole.

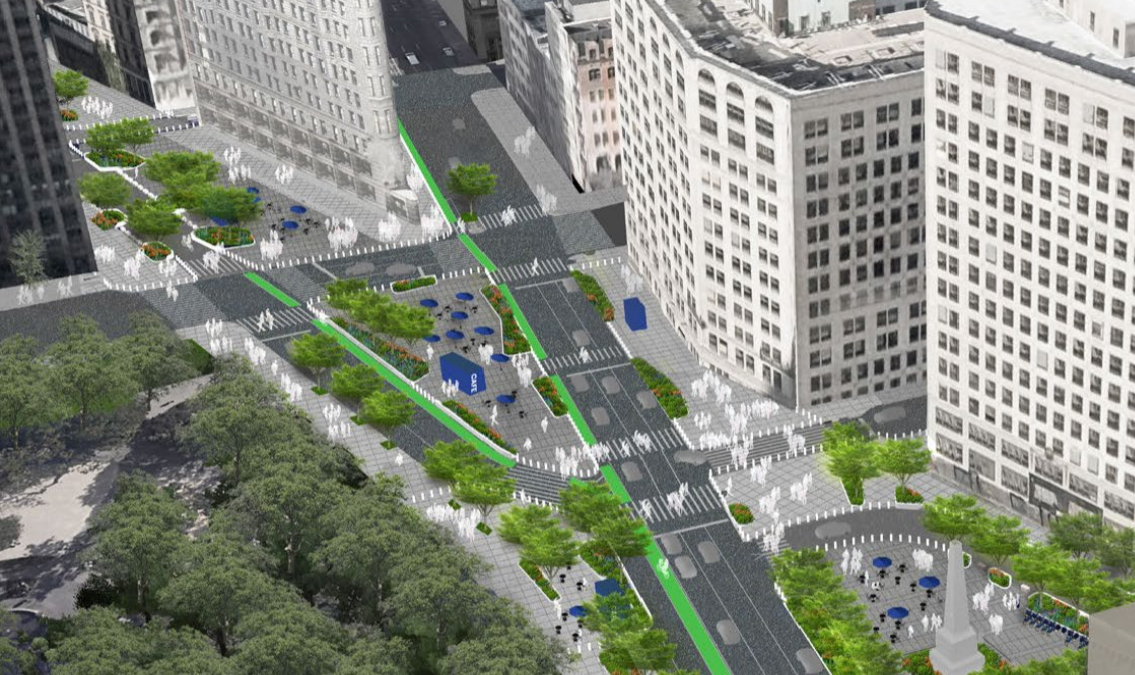

The other amendment would replace the Ravitch bridge tolls with a traffic-pricing plan that does three things the Ravitch tolls don’t do: (1) make Manhattan (and New Jersey) residents pay, (2) give drivers choices, and (3) save drivers time. Here’s how it works:

- One-way tolls of $1 or $2 or $3 or $4 or $5 to drive into the CBD (Manhattan south of 60th Street); the toll rate varies with time of day and weekday vs. weekend (nets $690 million a year).

- No cordon toll for taxis, but a 20% surcharge on all medallion taxi fares (nets $300 million, after assigning one-tenth of the surcharge revenues to drivers and owners)

(Click here for the Balanced Transportation Analyzer spreadsheet showing details.)

Why might this toll plan be a winner? First, drivers get a

toll choice, and their round-trip toll averages less than the proposed East River bridge tolls -- around $3.50 versus $4.50.

Second, drivers get valuable time savings: the estimated 10% speedup in traffic

within the CBD means that on a typical peak-period (weekday 6-9 a.m.) trip into the CBD, a driver whose time is worth

$45 an hour saves enough minutes to more than offset the $5 toll. Third, “outer borough” residents and Long Islanders see their toll burdens drop by a quarter

to a half, while Manhattan residents’

contribution to the revenues almost quadruples, from under 7% to 26%, and New

Jersey’s rises from 1% to more than 10%. Tourists

chip in too, through the taxi surcharge.

Neither the graduated payroll tax nor the traffic-pricing

proposal is exactly revolutionary. Indeed, both fit perfectly with the overall

Ravitch conception of rescuing the MTA through a three-part program of fare

hike + payroll tax + traffic tolls.

Pointing fingers at retrograde legislators has been

cathartic and by all means let’s hold them accountable. But it’s time to also

offer a better Ravitch Plan.