Por que no los dos?

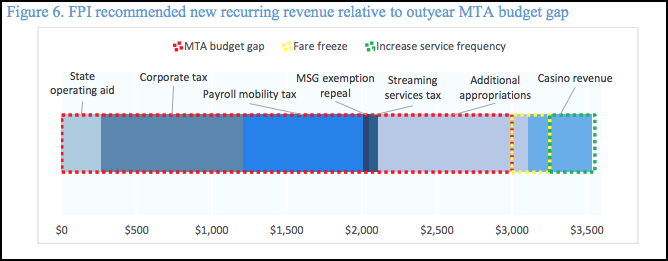

State leaders negotiating the overdue budget should take a page out of Old El Paso's book and raise $2 billion per year for the MTA by raising taxes on both payrolls and corporate profits, according to a new analysis from the progressive Fiscal Policy Institute.

Combining $850 million from an increase in the payroll mobility tax — which is favored by Hochul — with $950 million from a higher tax on corporate profits — favored by the state Assembly — would balance responsibility with fairness, the group said.

“While this [payroll] tax is formally paid by the employer, part of the cost will likely be shifted to employees," wrote FPI Executive Director Nathan Gusdorf and Senior Policy Analyst Andrew Perry. "Raising both the PMT rate and the corporate tax rate would be a holistically progressive proposal that maximizes fiscal stability and spreads the burden across both workers and corporate shareholders."

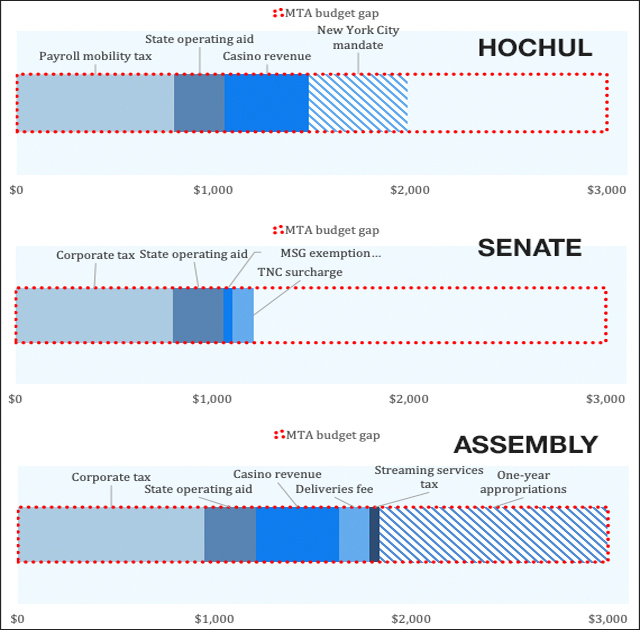

FPI's analysis stood up the proposals of Gov. Hochul, the state Senate and the Assembly for how much of the MTA's $3-billion deficit they would cover — concluding the state Senate's proposals would raise the least.

Each proposal draws on different sources to fill the agency's deficit:

- Hochul's budget proposal raises $800 million by lifting the highest level of the payroll mobility tax, a tax on business payrolls in the 12-county MTA service region, $500 million by shifting paratransit and student MetroCard costs to the city and $1.5 billion from casino license revenues downstate. It also directs a currently unknown amount of casino tax revenue to the agency when downstate casinos go online and hands the agency a $300-million one-shot emergency appropriation.

- The state Senate proposed raising the corporate franchise tax surcharge, a tax on businesses in the MTA region, adding an additional 50-cent surcharge on Uber and Lyft rides, revoking Madison Square Garden's property tax exemption and raising money with a residential parking permit system the City Council would have to implement.

- The Assembly suggested raising the statewide corporate tax rate through the year 2027 and giving the money raised in the MTA service region to the transit agency, giving the agency $906 million in state general funds to make up for the elimination of the payroll tax hike and $196 million to avoid a fare hike this year.

The Assembly's proposed 2027 end-date for corporate tax hikes rankled FPI as well as MTA Chairman and CEO Janno Lieber, who warned of adverse consequences of time-limited funding at Wednesday's monthly agency board meeting.

"One thing I did not like about the Assembly proposal was that it sunset in four years, so we have to go through this whole drama again," said Lieber. "The governor's plan really provided a path to a permanent financial security for the MTA."

The MTA's budget deficit stems from the steep ridership drop-off at the start of the pandemic, which has rebounded slowly as the city's economy has gradually recovered.

Ridership has previously accounted for about half of the MTA's revenue. With a projected best-case scenario of 88 percent of riders coming back by 2027, the MTA and state have to find recurring revenues that maximize year-to-year financial stability.

"We view the $3-billion gap not as a short-term problem that we have to bridge, but really a structural gap that every year, even 2027 and beyond, you're going to have to fill," Perry told Streetsblog.

"Our analysis treats that the gap as this recurring, structural gap. What we're looking for is recurring revenues since what we're thinking about is not in terms of what 2024 and 2025 look like to the MTA gap — but in five years, assuming that the structural gap remains, what are the sources of recurring revenue going to look like?"

A slick chart shows how the combo of the two proposed tax hikes would make it easier for officials to close the budget gap with smaller infusions of state aid and taxes, such as a proposed streaming tax or revenues from new casinos.

All the various proposals on the table added up would more than close the budget gap, allowing the MTA to avoid fare hikes or add service, the report said:

It's unknown when Hochul, Majority Leader Andrea Stewart-Cousins and Assembly Speaker Carl Heastie will settle on how to fill the MTA's budget hole, given that the leaders have said the budget will be late. Their negotiations typically happen behind closed doors, out of the eye of the public or press.

.@AndreaSCousins briefing reporters on the state of budget negotiations. Characterizes where things stand as “in the middle of the middle.” pic.twitter.com/CzvQjHOnuq

— Zack Fink (@ZackFinkNews) March 30, 2023

With that delay locked in, there is still time for legislators to negotiate service increases — especially since they've figured out some many ways to fund them.

"A late state budget means Albany still has plenty of time to save millions of city riders from 12-, 15-, 20-minute or longer waits for buses and trains," said Riders Alliance Director of Policy and Communications Danny Pearlstein.

"More frequent service is the only proposal on the negotiating table that will increase MTA ridership and foster fiscal sustainability following the worst economic crisis in transit history. That's why transit leaders have consistently urged recurring, reliable support to both maintain and expand the public transit service that makes New York possible."