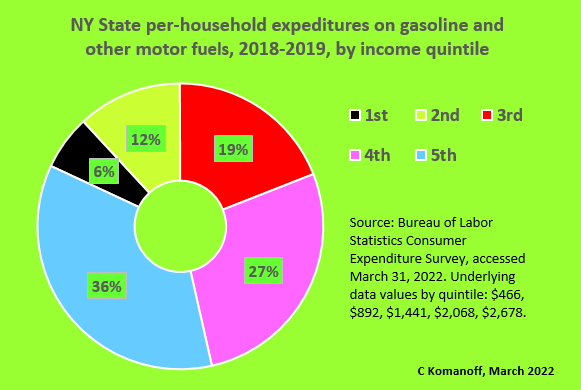

Rich families in New York State will benefit nearly six times as much as the poorest from a state gas tax “holiday,” according to U.S. Bureau of Labor Statistics household consumer-expenditures data for 2018 and 2019.

For every $100 in erased state gas and diesel-fuel taxes, the highest-earning quintile (20 percent) of households will take $35.50. The next most prosperous 20 percent don’t do too shabbily, either, getting $27.40. Yep, the top 40 percent earners will pocket 63 percent of the cash.

The poorest? Per $100 giveback, the lowest one-fifth of families get a $6.20 cut: two trips on a subway plus a few sticks of gum. For every buck pocketed by someone at the top, folks at the bottom get 17 cents.

As most readers know, gasoline tax holidays — suspensions or reductions in state gas levies — are shaping up as the primary U.S. policy response to runaway gas prices. Maryland and Georgia have already rolled out theirs, and similar giveaways are being readied in other states (NPR has a useful digest). New York transit advocates have focused their anti-gas-tax-holiday messaging, understandably, on the hit to transit funding from truncated state and metropolitan gas taxes.

The data here open up another front in the debate: For all the yadda-yadda about protecting beleaguered middle-class motorists, a New York gas-tax giveback will enrich those who need it least.

There’s a racial slant, too. Though BLS doesn’t report motor-fuel consumption by race, it does break down income quintiles between Black and non-Black households. Unsurprisingly, households headed by systemically disenfranchised “Black or African-Americans” make up 23.9 percent of New York State’s poorest quintile but just 8.4 percent of the wealthiest.

If we assign Black New Yorkers their quintile’s average gasoline consumption, we find that for each dollar in gas-tax givebacks to non-Black families, Black households are slated to receive 57 cents — less even than the historic racial pay gap in the United States which for decades has hovered at around the 65-cent mark. And even 57 cents almost certainly overshoots since it doesn’t account for Black families’ disproportionate concentration in New York City and other urban areas.

So, gas-tax holidays are anti-climate, anti-clean-air, anti-safe streets (more driving) and anti-economic equality and racial equity.

You might think a gas tax holiday will do less harm here. After all, even counting our suburbs and rural areas, New Yorkers drive a good deal less than people in other states. Well, you’d be right in absolute dollars, but wrong in proportions. Every one of the above figures skews worse in New York State.

Nationally, the ratio of motor-fuel expenditures between the top and bottom 20 percent of households is 3.3 to 1. In New York, it’s 5.7 to 1.

I only dug up the numbers for this post yesterday afternoon. (I previously had national gasoline use broken down by quintile, but not New York’s specifically.) I’m amazed no one seems to have brought them into the discussion of a possible state gas-tax holiday. With due respect to both climate, which I work on professionally, and transit funding (ditto), the economic inequity of cutting gasoline taxes should have been at least as prominent.

I estimate that complete suspension of New York’s motor-fuel tax would cost the state treasury $250 million a month. Continued for a year, it would put $1.1 billion of found money in the pockets of the richest 1.6 million state families — more even than the $800 million Albany is set to throw at the new Buffalo football stadium. The bottom one-fifth of families would receive a relative pittance, $180 million.

We know where Republicans stand on economic inequality. They’re for it. But do state Democrats really want to push a policy that makes our state, the most unequal among the 50, even more so?

And don’t ignore the symbolism. The last $1 or $1.50 of the 2022 rise in gasoline prices was sparked by Russia’s invasion of Ukraine, the cause of widening destruction and death. Americans ought to be avidly tightening our petroleum belts, conserving every ounce of fuel we can to free up supplies for consumers in other countries, who on average burn half as much fuel as us or even less. It would also soften prices, helping everyone except Putin, Exxon and the Saudis.

Cutting fuel taxes goes against that, while making it even easier for motorists to continue ignoring the best means of bearing the brunt of costlier gasoline: driving and burning less.

Charles Komanoff is the leading expert on congestion-pricing modeling and carbon taxation. He is a regular Streetsblog contributor.