Is the MTA getting a new funding source for Valentine's Day?

With updates to the executive budget due this week and next, advocates are asking Gov. Hochul to show the MTA love by giving it a bigger cut of gas tax revenues than it currently gets. It sure beats flowers.

Budget watchers are waiting to see if the governor's 21-day or 30-day budget amendments will include a proposal, first promoted by former Comptroller Scott Stringer and brought up in late January by his successor, Brad Lander, that would reconfigure the way gas taxes are distributed in the state. Under the idea floated by the comptrollers, and embraced by some rider advocates, the MTA would reap two-thirds of the gas taxes collected in the 12-county MTA service region, instead of the current scenario where the transit agency gets one-third and the Highway Bridge and Trust Fund gets two-thirds of the funds known collectively as Petroleum Business Taxes.

Car-culture enablers would argue that rejiggering the gas tax distribution is a cut to road funding, but bridges and highways around the state are well represented in the ongoing federal cash orgy going on in New York.

"The federal infrastructure bill, as much as it brings in for transit, is also a game changer for roads," said Riders Alliance Policy and Communications Director Danny Pearlstein. "And that means the state can afford to move its own money to more pressing priorities than road expansion."

Much has been made of the generous mass transit relief that the federal government has provided the MTA over the life of the pandemic, but President Biden has made sure that the state is also flush with cash for its various highway and roads projects also. The governor is planning some state-of-good-repair projects, including a promised politically popular pothole-paving program that will cost $1 billion over five years. But the $32.8-billion state Department of Transportation capital program is being funded with $13.5 billion from last year's federal infrastructure bill to do extremely uncool things like widen the Van Wyck Parkway, Riders Alliance pointed out.

"Widening the Van Wyck is not about state of good repair," said Pearlstein. "It's a vanity project that will cause more driving, and lead to more traffic and pollution. So there's just there's such a vast gulf between state of good repair projects, and expansions in our roadway network at a time, we know that driving is leading to out of control climate change."

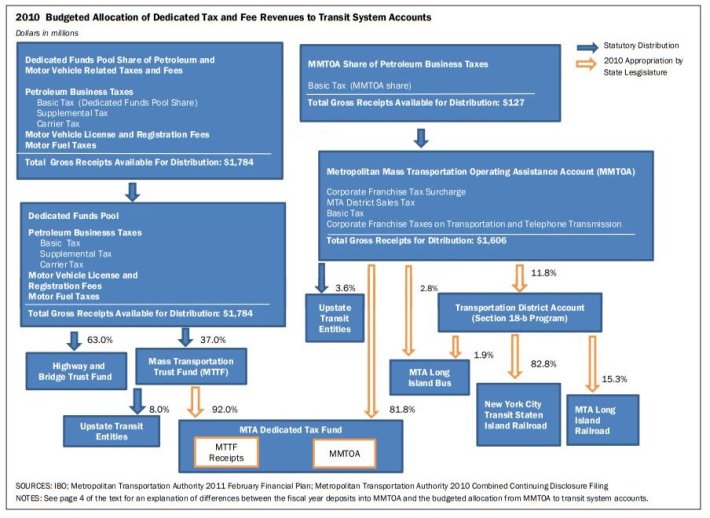

The proposal to reallocate gas taxes and weight them towards mass transit is a relatively simple one, in the sense that the taxes involved are already set and are collected by the state, and then allocated as 63 percent to the highway and bridge trust fund and 37 percent to a transit trust fund. The transit funds are then further filtered down between the MTA's operating budget and money given to various upstate New York transit agencies. Here's a flowchart, it's all laid out in the boxes on the left side of the chart.

In the November Financial Plan that laid out the MTA's 2022 budget, the agency projected that it would get $602 million from the gas taxes, and then $592 million each year from 2023 to 2025. If the state decided to invert the way the gas taxes are allocated, it would mean in 2022 the MTA would get a staggering $1.115 billion from fund, an increase of $513 million this year, and could further project $1.096 billion for 2023 to 2025.

While tilting gas tax revenues towards more good than evil has a certain appeal, there is a problem inherent in relying on them to do too much for too long. After all, the state and the country are moving away from gas-powered vehicles and towards the use of electric vehicles, which means that the new ratio would itself be a temporary fix. The Citizens Budget Commission for instance, has suggested that the state move towards a vehicle mileage tax to fund transportation improvements. But as long as the gas tax is the thing in this time of big federal money for roads, Pearlstein argued that the state should make the most of it.

"The priority right now is bringing the subway back, and with it New York. It seems a shame to prioritize projects that don't do that with a gas tax, when without changing revenue sources at all, you could find the dramatic recovery of the subway system," he said.

Hochul, who has at least upped the amount of money for the operating budget in the Fiscal Year 2023 budget, is playing things somewhat close to the chest; a spokesperson said that she would review the proposal.

MTA Chairman and CEO Janno Lieber, who has talked since late last year about the need to find new revenue sources for the MTA so that it's funded more like an essential service like fire or sanitation, didn't take a position on the gas tax proposal. But he also emphasized the need to fill the MTA's coming fiscal hole, and credited advocates and lawmakers for expressing support for the gas tax inversion, making it possible to read between the railroad ties to see some support for it since it would be a new recurring revenue source for the agency.

"We are asking for in the next couple of years, for there be additional recurring resources given to the MTA to make sure that we can close that multibillion-dollar structural budget gap," said Lieber. "The decisions about which different taxes or which different sources should be utilized is really for the governor, the legislature to decide.

"But the legislators and other people who are putting those ideas on the table are doing us all of your service because what they're doing is getting everybody to focus early that this is a real issue, and it needs to be addressed," he added. "So without taking a position on a specific tax adjustment, I say bless those legislative readers who are raising the issue and coming up with ideas and starting the discussion."