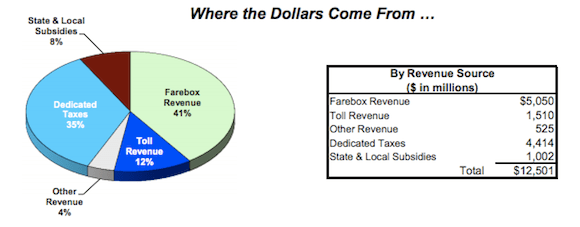

Saying that the “budgetary crisis of the MTA is not a substantial state concern," a state Supreme Court judge ruled yesterday that the MTA Payroll Mobility Tax is unconstitutional. Although taxes will continue to be collected as the MTA appeals the case to a higher court, yesterday’s decision puts $1.5 billion, or approximately 12 percent of the MTA’s annual budget, at risk.

By comparison, sweeping service cuts enacted in 2010 saved the MTA $93 million. The amount affected by yesterday's decision is 16 times larger.

The MTA serves a region that provides the bulk of the state’s tax revenue, and its finances are a perennial point of conflict in Albany. However, Judge R. Bruce Cozzens, Jr., a Conservative Party member who was re-elected to the court in 2011, brushed off the importance of the MTA to the state.

“It is hard to see,” he wrote, “how the residents in Buffalo or other upstate areas… would be affected. If this matter really is a substantial state concern, then the legislature could have reasonably taxed every county within the state,” instead of just those served by the MTA. Judge Cozzens ruled that the state should have obtained home rule messages from the affected counties before enacting the law.

The court decision strikes not just the Payroll Mobility Tax, but all other taxes created to address the MTA funding gap in 2009. The PMT, a 34-cent tax on every $100 of payroll paid by public and private employers in the 12-county MTA region, generates $1.2 billion annually. Additional taxes affected by yesterday’s court ruling – a 50-cent taxi ride surcharge, a rental car tax, motor vehicle registration fees and driver’s license fees – raise $300 million.

Cozzens' decision does not affect taxes created before 2009 to fund the MTA, including the mortgage recording tax and the petroleum business tax.

Nassau County Executive Edward Mangano, later joined by Westchester, Putnam, and Suffolk Counties, as well as other suburban jurisdictions, brought the case nearly two years ago and celebrated yesterday’s decision. “This success sends a strong message to job creators,” Mangano told Newsday. “This is a historic victory for tax relief and tax reform.”

The county will seek to have mobility tax payments it made returned, though it may not be able to do the same on behalf of private employers who have paid the tax. When Mangano launched the suit in 2010, he told reporters, “We want our money back.”

To reach that point, the decision would first have to survive an appeal by the MTA, which said in a statement that it “strongly believes that yesterday's ruling from Nassau Supreme Court is erroneous.” Noting that four other Supreme Court challenges to the Payroll Mobility Task brought by Long Island towns were dismissed, the agency expressed confidence that it would prevail in court. “The Payroll Mobility Tax remains in effect for now,” the MTA said, “and we expect that it will survive this legal challenge.”

If the tax were ultimately overturned in the courts, it would devastate the MTA's finances. Dedicated taxes make up 35 percent of the agency’s 2012 budget. One in three dollars in that pot is affected by the court’s ruling. With such a major cut to the MTA budget, train and bus riders would face major service cuts and fare hikes unless politicians come up with another source of revenue.

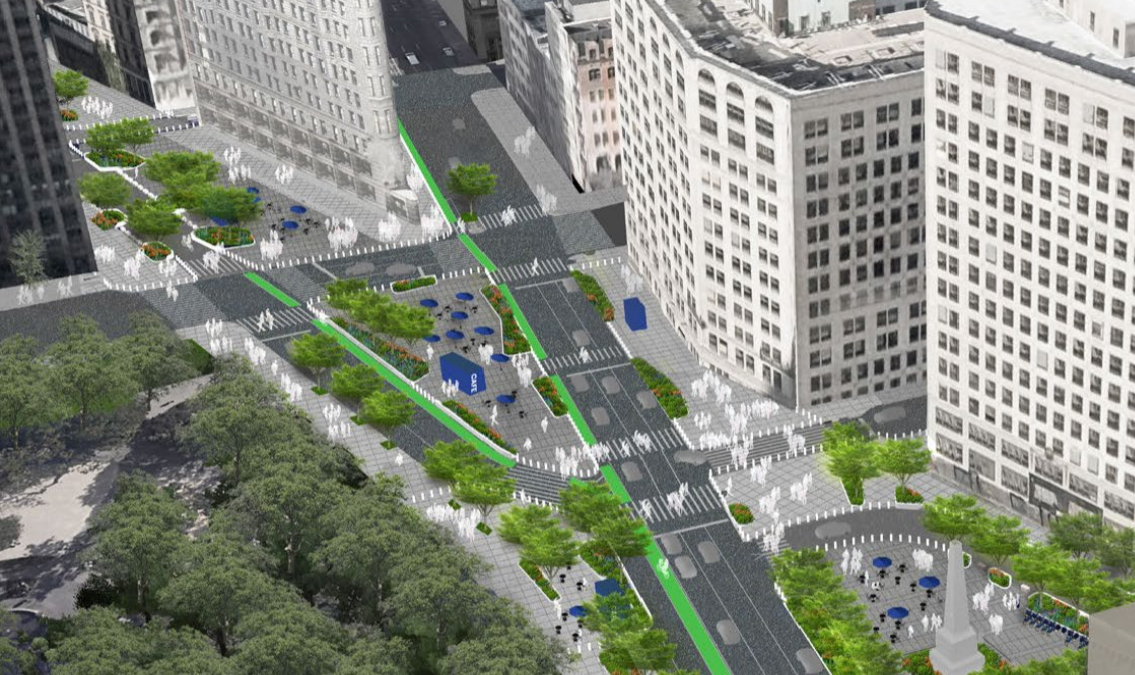

Governor Cuomo, who trimmed the Payroll Mobility Tax last year, said this morning that he "believe[s] this ruling is wrong and will be reversed." Advocacy groups are already putting forth potential funding alternatives in the event that the ruling stands. “New revenues must be found,” said Tri-State Transportation Campaign Executive Director Veronica Vanterpool, either “through congestion pricing, tolling, or other means.”

The next likely step for the case is the Supreme Court Appellate Division’s Second Department, which includes judges from all of the counties affected by the payroll tax, excluding Manhattan and the Bronx. From there, the case could go to the Court of Appeals, New York’s highest court.