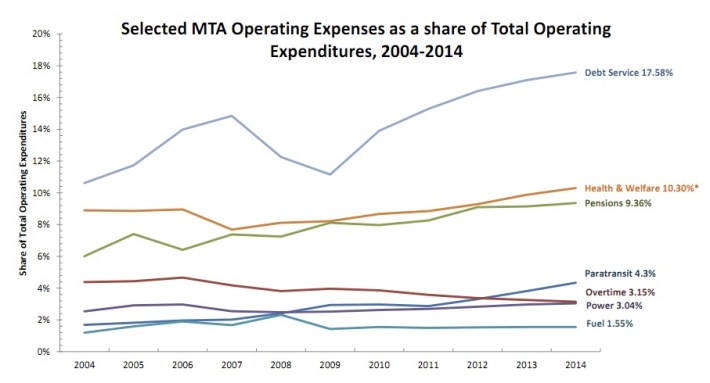

Yesterday, we reported on the MTA's ever-mounting debt load. By 2014, a new analysis from the Regional Plan Association found, debt service could be taking up a full 23 percent of the agency's operating budget.

Already, that debt is starting to catch up with transit riders. As first reported by Transportation Nation's Andrea Bernstein, Fitch, one of the three major ratings agencies, has downgraded the MTA's debt. That could mean higher payments for the same amount of debt, and therefore higher fares down the line. Wrote Fitch in a press release:

The downgrade reflects higher than expected near-to-medium term financial pressure stemming from increasing operating costs (projected to moderate in growth in the outer years) and pension obligations and growing annual debt service obligations from expected near-term issuance associated with the capital program. This is exacerbated by the strong likelihood that operating subsides (dedicated tax sources) will not grow as anticipated in the near term leading to wider deficits.

The MTA downplayed the significance of the downgrade in a statement. "While a downgrade is never welcome news," said an MTA spokesperson, "we believe the strength of the credits remains fundamentally secure. We also believe that the impact of the Fitch rating action is largely priced into the market already and that any pricing impact would be minimal."

We'll have more on the story as the financial implications of the downgrade become clear, but one thing is for certain. The markets are taking the MTA's fiscal situation very seriously. It's time for Albany and Governor Cuomo to do the same.