There have been warning signs about the growth in subprime auto loans for years now. But the issue got some very high-profile attention last week when JP Morgan Chase CEO Jamie Dimon raised concerns that there may be a bubble in the auto lending market.

Since the economic recovery began, lending institutions have actually loosened standards for car loans. The auto finance sector was excluded from regulation by the Consumer Financial Protection Bureau, which was created after the housing crisis to help regulate the consumer banking and credit industry.

Since then, more Americans have chosen to borrow to pay for their cars. About 86 percent of new cars were financed in 2015, up from 80 percent in 2008, according to Tony Dutzik of the Frontier Group, who has been researching the issue. For used cars, the financing rate rose to 55 percent in the second quarter of 2015 -- about 7 percentage points higher than in 2010.

Lower-income borrowers account for a large share of the growth in car loans. According to a 2014 New York Times story, subprime auto lending increased 130 percent in the five years following the recession.

Evidence suggests consumers are being stretched thin. Default rates have been climbing. CNN Money reported in March that unpaid subprime car loans are at a 20-year high. As Dimon indicated, this may pose a risk to the broader economy.

But the core issue, says Carjacked author and Brown University professor Catherine Lutz, is the high cost of car dependent development patterns for low-income people. The subprime auto market is booming because in so much of the country, owning a car is a necessity to access employment and other basics.

"If you look at what people have to pay to stay in a car it’s a phenomenal amount of money," she said. "The bottom two [income] quintiles often have zero equity in anything. So to get a car they have to take a loan."

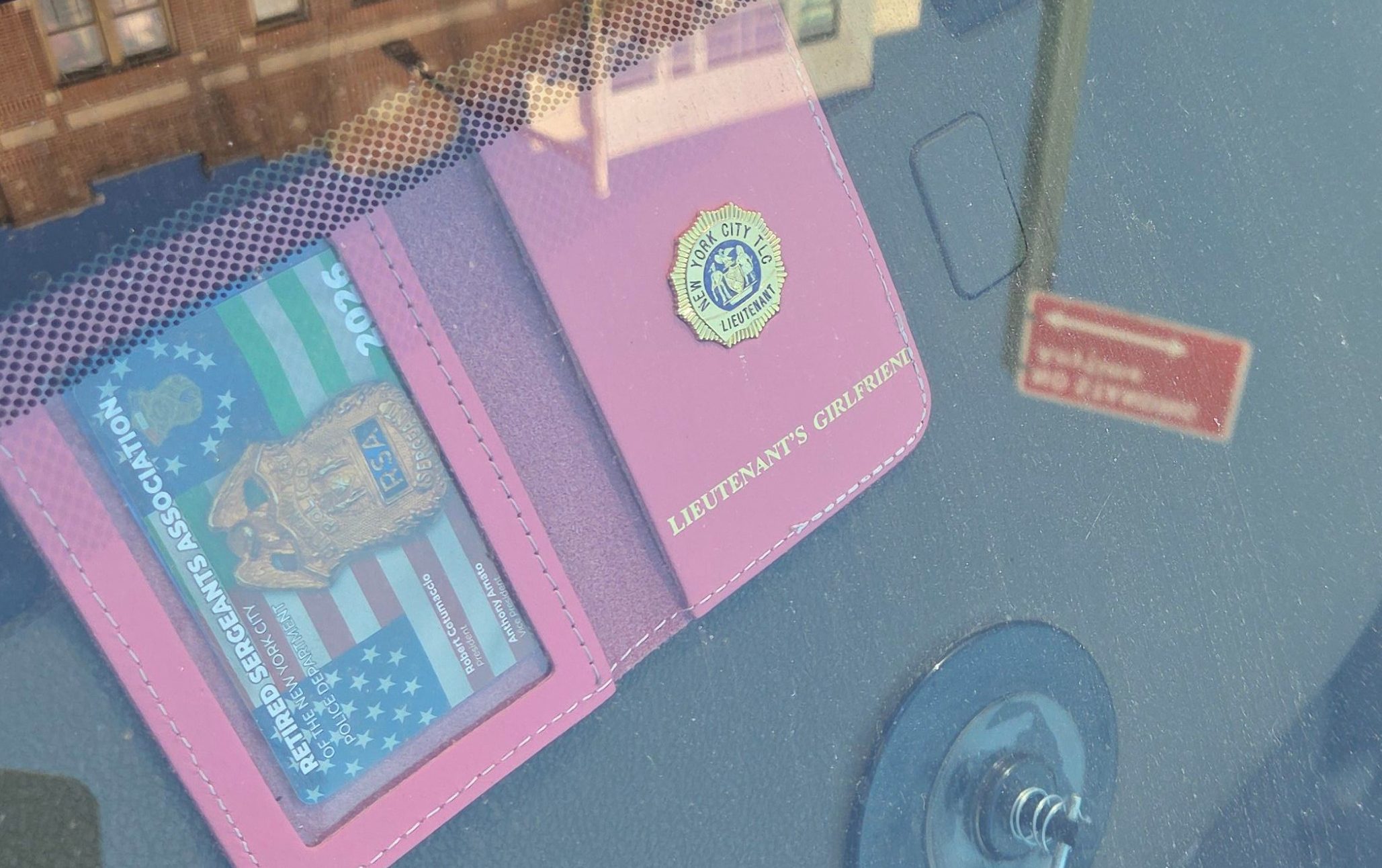

"The car lenders have really been quite predatory to people from working-class backgrounds," she added. "They’re coming in with a low credit score and not a lot of negotiating power. Maybe they need a car the same day because their car has broken down. They get crummier loan conditions and higher prices. The poor pay more for the same car than the rich do."

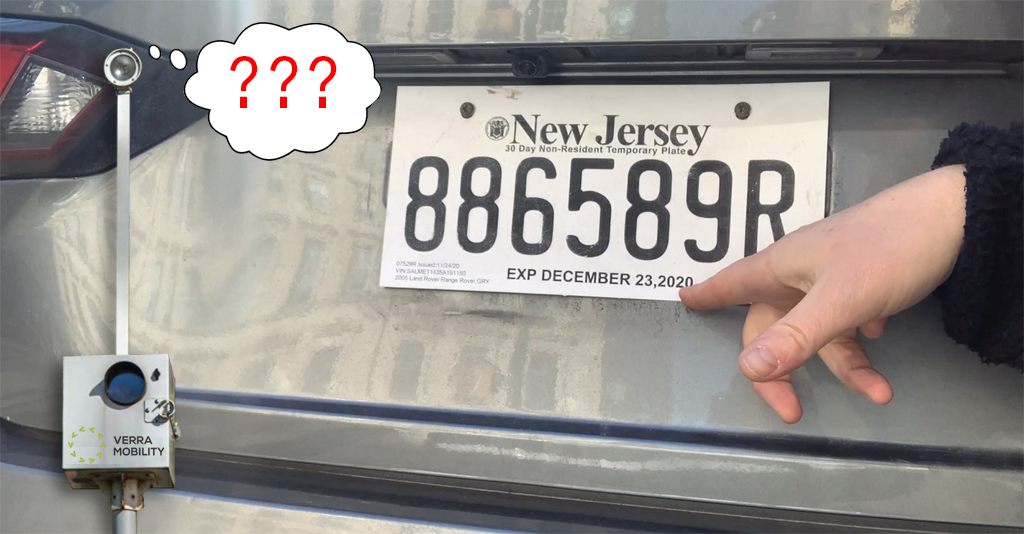

The typical length of an auto loan used to be about four years -- 48 months. But that is getting stretched. Now people can, and often do, secure 72 month loans for auto purchases.

"Those are really dangerous because a car breaks down. It’s not like a house," said Lutz. Borrowers take out loans "in the hopes of having the car be operable at the end of it. If not they still owe money on a car they didn’t own."

The problematic trend isn't that more Americans can't access transit since the recession, Lutz says. It's that poor people are getting poorer because of wage stagnation, while cars are getting more expensive. The average new car cost about $31,000 in 2015, according to USA Today, and a used car about $16,000 -- a 3.5 percent increase in two years.

But in most places, going without a car is worse than going into debt to acquire one. According to a 2011 Brookings study, the typical resident of a U.S. metro area can only access about 30 percent of the region's jobs within a 90-minute transit commute.

"If you are in a situation where you do need to drive to get to work and to get your needs and you don’t have good credit, you can find yourself in this cycle of ever deepening debt," said Dutzik.