A dispute between NYC DOT and the company that runs Citi Bike threatens to rob New York City's bike-share expansion of the very quality that's made the existing service so useful. The key issue is station density, and whether the stations where Citi Bike expands will be within easy walking distance of each other like in the rest of the system.

The density of stations in the current Citi Bike network sets it apart from other American bike-share systems and helps explain why it's used much more intensely. You can go anywhere in the service area and know that a station to pick up or drop off a bike is a short walk away. But DOT's bike-share maps for the Upper East Side and Upper West Side abandon this core design principle.

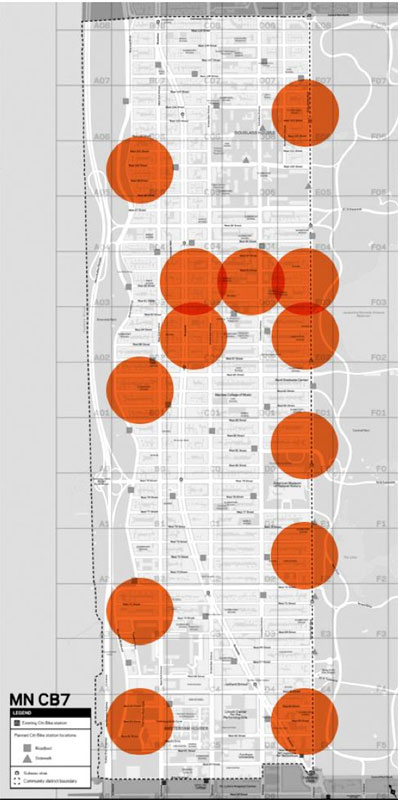

The expansion plans for these neighborhoods each fall about a dozen stations shy of the density recommended by the National Association of City Transportation Officials, 28 per square mile [PDF]. On the Upper West Side, for instance, you can see the station deficit in this visualization produced by Transportation Alternatives -- each orange disc represents a zone that should have a bike-share station in DOT's plans but doesn't.

The dearth of stations has been abundantly clear to participants at public meetings about the expansion, but when Streetsblog asked for comment from City Council members Helen Rosenthal and Ben Kallos, neither office wanted to speak up on the issue.

The Upper East Side and Upper West Side are two of the most densely populated neighborhoods in New York, right next to Midtown and all its jobs. Both areas also have large museums and hospitals and lots of latent demand for convenient cross-town travel. The appetite for bike-share should be enormous, and so should the revenue from Citi Bike memberships and day-passes -- revenue that can, in effect, subsidize bike-share service in less dense parts of town.

That's why thinning out the network in these expansion areas risks more than inconveniencing bike-share users who live in the neighborhood. If people can't expect a short walk to and from stations, and if they can't count on a redundant station nearby in the event their preferred station is full or empty, they won't pay for bike-share and there won't be much revenue to redirect toward service in other areas of the city.

DOT's reluctance to go with the NACTO-recommended station density is tied to a dispute with Motivate, the company that runs Citi Bike.

While the bike-share contract stipulates that the service area should meet the 28 stations-per-square-mile standard, it also lays out a minimum expansion zone (here's a look at the area planned for "Phase 2") while saying Motivate can't be compelled to add more than 378 stations. Those numbers don't add up: Covering the expansion area with 378 stations falls short of the station density target.

The situation could be resolved with some give and take between the parties, and DOT says it is in talks with Motivate about raising the number of stations in the expansion zone. But the way things stand now, Motivate's desire to avoid spending on additional stations and DOT's desire to reach every neighborhood in the promised second phase are combining to sabotage the effectiveness of the bike-share system as a whole. It's going to be spread too thin.

In a statement, DOT said that the "principle of equitable distribution is a foremost priority" for the agency, which is "committed to a bike share that delivers the same standard of service to Van Brunt Street and Astoria Boulevard as will be provided on Madison Avenue and Central Park West."

There are ways to reach the less affluent neighborhoods in the expansion zone without undercutting the system in very high-demand areas, however. DOT could, for instance, hold off on expanding in Park Slope and use those stations where they're most needed to buttress the network. More generally, Citi Bike's ability to attain DOT's goal of broad coverage will be constrained if the system isn't set up to perform well in the areas capable of spinning off revenue to support service elsewhere.

Motivate, for its part, cited the significant progress it's made upgrading software, hardware, and bikes to improve the customer experience. The company noted that its first expansion will bring 92 stations to Bed-Stuy, Williamsburg, Greenpoint, and Long Island City this year. "What's new now is the UES and UWS," said a spokesperson via email. "We are trying to work with DOT to ensure that we have the density needed there to meet demand. That's the next challenge to be solved and that’s where we’re focused right now."

Given all the resources the company has already plowed into turning around Citi Bike, though, it's hard to see why Motivate won't spend a bit more to ensure those investments actually pay off as its flagship system grows.