As the MTA capital plan funding gap has come into focus, there's been a lot of discussion about how new development can help pay for the transit service it requires. It turns out the city already has a tool that links real estate with transit improvements, but it's so limited that it's been used to fund transit upgrades only 10 times in more than three decades. For a more robust model, planners should look to San Francisco.

In 1982, the Department of City Planning created the "subway bonus," which allows developers to construct buildings up to 20 percent larger than normally allowed. In exchange, the developer must pay for and install subway station improvements requested by the city.

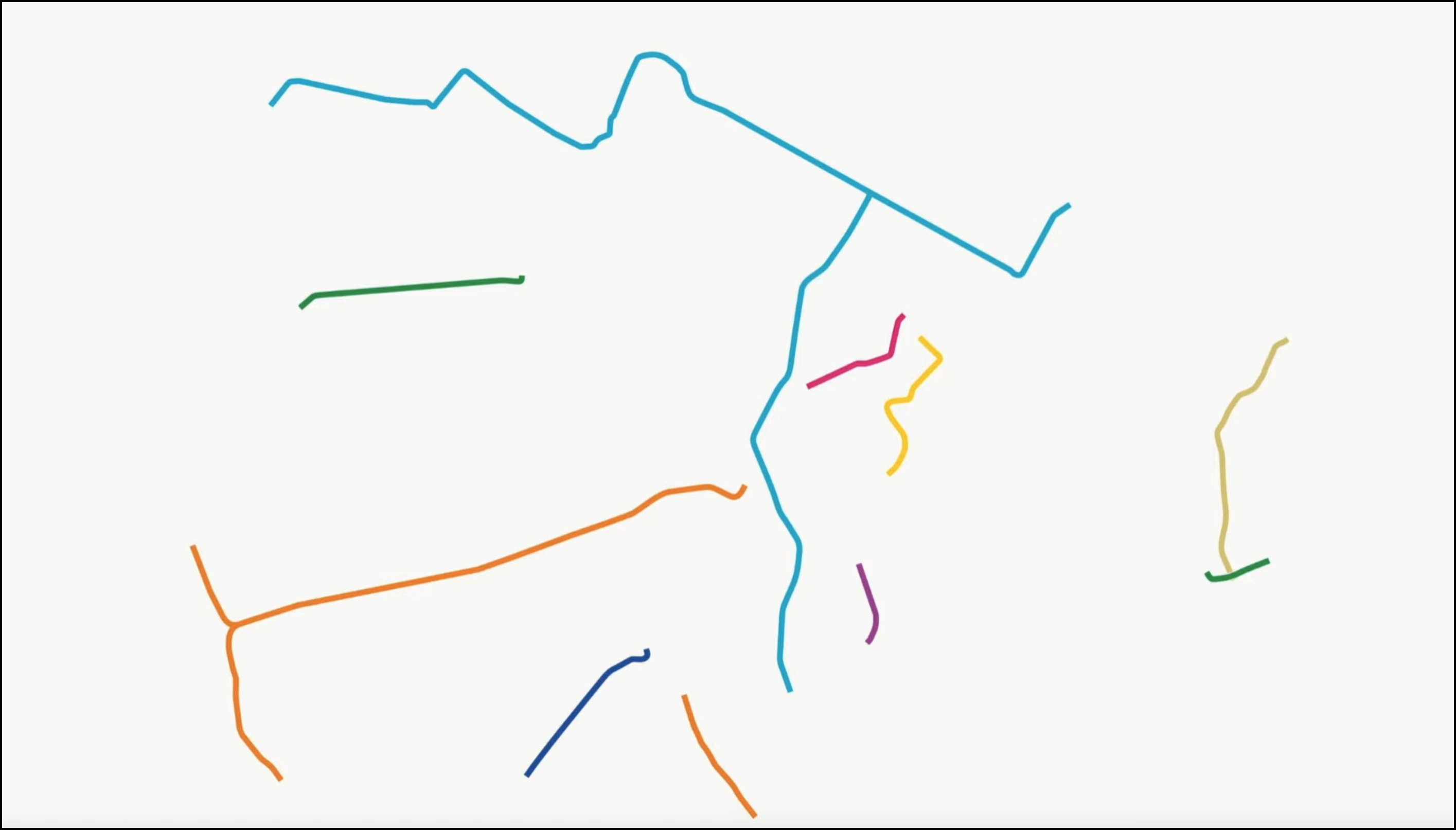

The subway bonus only applies to sites adjacent to a subway station. At first, it only covered qualifying sites in Midtown. The program was expanded in 1984 to more of Manhattan and Downtown Brooklyn; in 1986, a slightly modified subway bonus was created for the Court Square area of Long Island City. In addition, the city requires developers atop future Second Avenue Subway stops to keep a public easement in new development for future station entrances.

Although tools to extract transit improvements from developers pop up sporadically in the city's zoning code, only 10 projects have used the subway bonus program since it was first created in 1982, according to a DCP report [PDF]. The report also lists two completed projects and one proposal that offered subway improvements using other incentive programs.

Most of these projects brought upgrades like wider platforms, new or expanded walkways between stations, elevator installations, and redesigns to allow more natural light into subway stations, among other changes.

These projects might be familiar to regular subway users. The Lexington-53rd Street station, for example, received upgrades from office towers at 599 Lexington Avenue and the "Lipstick Building" on Third Avenue. In other locations, the developer of Zeckendorf Towers expanded the mezzanine at Union Square, new office buildings brought connections between platforms at the Court Square station, and the Hearst Building added stairs and elevators at the southern end of Columbus Circle.

The city is moving forward with a modified version of the subway bonus on Vanderbilt Avenue, where it is working with developer SL Green to swap increased density for a pedestrian plaza and station improvements beneath Grand Central Terminal.

While this handful of projects over the years have provided beneficial upgrades to the subway system, it's hard to see them as anything more than spot improvements that occur only if a big new office building happens to be located on top of a subway station. New development a block away from the subway creates just as much demand for transit, but there's no mechanism in the city's zoning code to recapture the costs of providing that service. What's missing is a more comprehensive value capture system.

The city's biggest value capture experiment to date is the scheme it used to fund the 7 train extension to Hudson Yards. The city paid for the project by banking on future property tax revenue from new development. When that new development failed to materialize as quickly as planned, city taxpayers were left holding the bag.

Instead of making the risky decision to rely on future revenue to fund an enormously expensive project, the city could require developers to pay an up-front impact fee when a project is built. San Francisco created a transit impact fee for new downtown development in 1981, and expanded the program citywide in 2004. Today, it generates millions of dollars each year for transit. San Francisco's decades of experience could be a starting point [PDF 1, 2]. For example, New York could tie a transit impact fee to specific transit corridors. It could also link the fee to a commensurate reduction in parking requirements to offset the cost.

Revenue from the real estate sector can be volatile, but transit impact fees have two key advantages. Unlike the Hudson Yards financing plan, which relies on promised revenues, impact fees are cash in hand for the transit provider. And unlike the regional real estate transfer taxes already collected for the MTA, a transit impact fee can be targeted to areas where new development places the greatest strain on transit services.

San Francisco's planning and transit departments are both controlled by the mayor, making it easier to connect the two. Here in New York, the MTA is a state authority while city planning is a local concern. Nevertheless, officials are already talking about the relationship between zoning and transit funding. Council Member Dan Garodnick, for example, has been heavily involved in discussions to use zoning to pay for transit upgrades in Midtown East, and City Planning Commission Chair Carl Weisbrod has expressed interest in doing more value capture projects like it. Transportation Commissioner Polly Trottenberg has said that zoning changes should accompany transit investment and called value capture "a valuable tool" for funding transit.

The Municipal Art Society requested the subway bonus report from the city. "We were shocked to learn it has only been used a handful of times in three decades, during a time when the MTA has been struggling with deficits of billions of dollars, and our infrastructure is in vital need of repair," said Kate Slevin, vice president of policy and planning at MAS. "Until we find a way to funnel more of this development revenue into transit and public realm improvements, the city is leaving hundreds of millions of dollars a year on the table."