De Blasio’s Wrong: There’s a Fair Congestion Pricing Plan Right Under His Nose

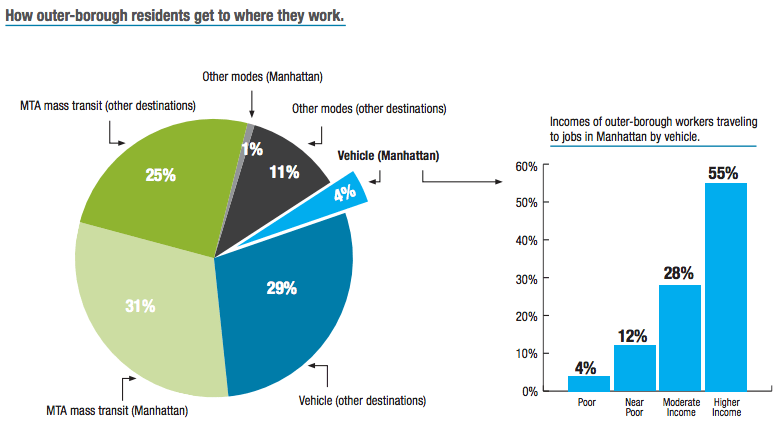

Just 4 percent of outer borough workers commute by car into Manhattan. Of those, the vast majority are from middle- or high-income households. Image: Community Service Society

Stay in touch

Sign up for our free newsletter

More from Streetsblog New York City

EXCLUSIVE: OMNY Debuts on Fair Fares After Delays

The long-awaited Fair Fares expansion will launch as a three-month pilot for a few dozen riders.

Good Luck Docking Your Citi Bike In Lower Manhattan

Many frustrated commuters to Lower Manhattan opted to simply abandon their Citi Bikes undocked due to the lack of open spots in the area.

Wednesday’s Headlines: ‘ACE’ in the Hole Edition

The MTA approved a $141-million contract to put hundreds of new automated traffic enforcement cameras on buses. Plus more news.

Trump Trial Street Closures Push Pedestrians, Cyclists into Busy Traffic

News vans have dangerously blocked the sidewalk and bike lane on Lafayette Street daily since Donald Trump's trial began nearby two weeks ago.

Eyes On The Street: Coastal Resiliency Causes Mess For Pedestrians and Cyclists

Unfortunately for cyclists and pedestrians, this situation won't be fixed until "at least 2026.”