With the election over and Albany in session, the time for tiptoeing around the $15.2 billion gap in the MTA's next five-year capital program is over. Today, three former MTA chiefs lined up to say that, one way or another, the plan must be fully funded.

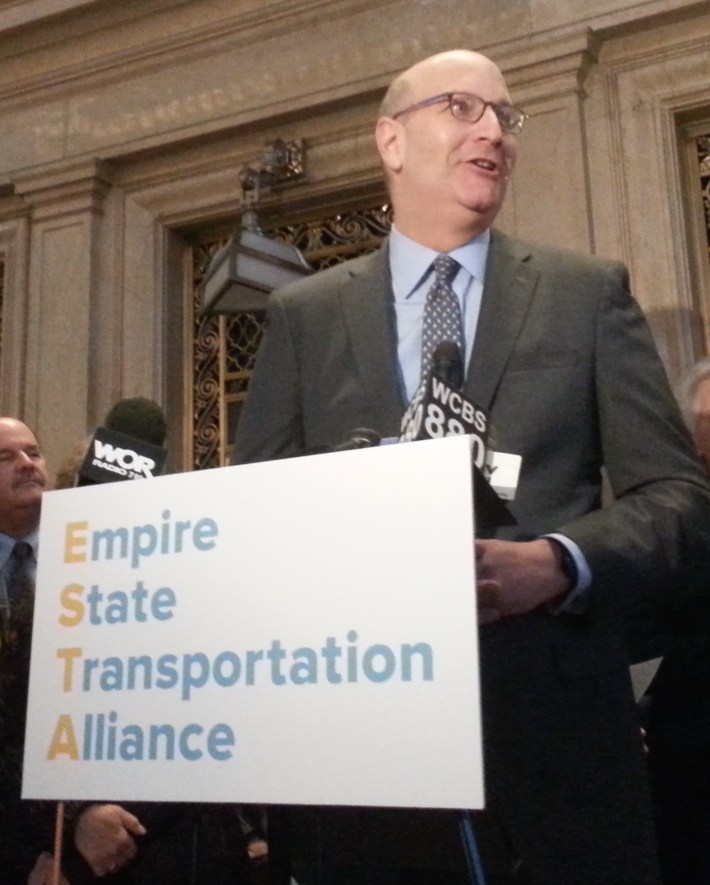

"The governor, the legislature, and the mayor must do the heavy political lifting to find new revenue sources," said former MTA chief Elliot Sander, joined by fellow ex-MTA leaders Peter Stangl and Jay Walder this morning in Grand Central Terminal. A roster of NYC civic groups and private sector interests, from environmental advocates to big business to the construction industry, stood behind them in support.

"The message today, in case you haven't heard it, is 'mind the gap,'" said Regional Plan Association Senior Advisor Bob Yaro. "Everybody's gonna have to belly up for a piece of it."

A variety of solutions have been floated to fill the funding gap, from a gas tax increase to a regressive sales tax hike. The best one from a transportation, environmental, and economic development perspective would involve reforming the region's dysfunctional toll system. While no one speaking today would come out in favor of one fix over the others -- "this is not the time for that," Sander told a scrum of reporters after his remarks -- with Albany in session, the clock is now ticking.

Ultimately, closing the capital program gap is up to Governor Andrew Cuomo and the legislature.

The governor is set to combine his State of the State speech and budget address in one event on January 21. I asked Sander if he is looking for Cuomo to say anything about the MTA during the speech. "Whatever works for the governor and the legislature and the city in terms of how to deal with it," he said. "We don't -- you know, no."

Sander was less circumspect about City Hall's role. "I think there's a recognition by the mayor's senior staff that the city may need to contribute more. There's no greater beneficiary than the City of New York," he said. "I am optimistic that the mayor will be there."

In the 1980s, the city sent $200 million each year to the MTA's capital budget before dropping its annual commitment to $100 million in the 1990s, where it has stayed ever since. The MTA already assumes the city will increase its annual contribution to $125 million for the next capital plan. But even a sizable boost from the city will go only part way to closing the $15.2 billion gap.

The ultimate solution must come from the governor. After calling the capital plan "bloated" at one point last year, Cuomo decided to keep his options open and say that "everything is on the table."

Without a new revenue source, the MTA will likely take on more debt. The agency already spends 17 percent of its operating budget on debt service, and is planning to issue $6.2 billion in additional debt for the next capital plan. Sander said he is "comfortable" with that proposal but is worried that elected officials could paper over the funding gap by cutting investments and piling on more borrowing for the rest, leaving straphangers to pick up the tab.

"More debt and higher fares, and a reduced program. That is our greatest fear," Sander said. "The public may not see the impact until several years later when the damage has been done."