Council Member Ruben Diaz spent much of the day saying that he's the victim (NYDN) because people are criticizing him for his three consecutive days of homophobic remarks. He rejected Council Speaker Corey Johnson's call for him to resign (NY Post). The Times offered a review of decades of Diaz's most repugnant comments. Council Member Jimmy Van Bramer will lead a protest against his anti-gay colleague on the steps of City Hall at 10 a.m.

Two hours later, Families for Safe Streets will demand the Council pass a Brad Lander bill that would help get reckless drivers off the road. The bill is sponsored by 24 members of the Council — but not Ruben Diaz Sr.

Meanwhile, here's the news:

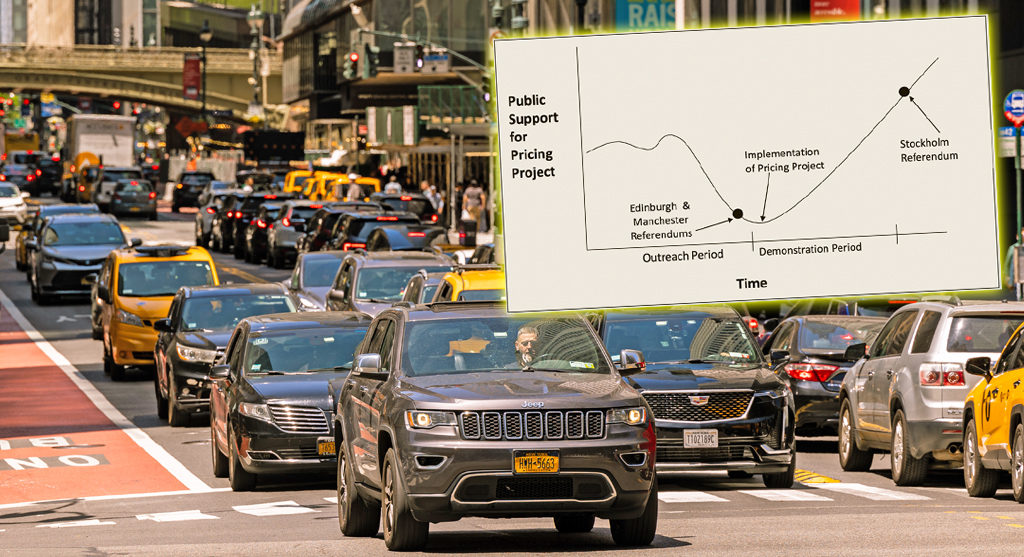

- Mayor de Blasio went to Albany, where he did a terrible job of supporting congestion pricing (which he doesn't likely actually support, as the Wall Street Journal flatly pointed out). The Post focused on his support for a toll exemption for farmers to deliver produce to Manhattan greenmarkets — suggesting that poor greenmarket shoppers in Manhattan would suffer unduly if farmers passed along the $5.76 toll to their customers. He also wants carve-outs for small businesses and people who need a car to see a doctor. Assemblyman Bobby Carroll pounced on the mayor's weak support for congestion pricing, which only encouraged outer-borough opponents to again begin their reflexive defense of the non-existent hordes of lower-income drivers who they believe commute into the central business district of Manhattan. (NY Times, amNY)

- Just because we know what caused the L-train stink doesn't mean it's going away. (Gothamist)

- The Post followed our exclusive on Council Speaker Corey Johnson's bid to outdo the mayor and actually do something on placard abuse. (NY Post) True gentleman Vin Barone at amNY also followed our scoop, but he gave us a nice hat tip.

- Car carnage in the Bronx kills one. (NYDN, NY Post, Gothamist). And a senior citizen was hit by a bus in Manhattan. (Gothamist)

- The Times did a nifty photo spread on how bad the subway is (make sure you click all the way through to see the photo of the pole in the newly renovated station blocking a turnstile). That said, delays were down last year.

- A new data-scrapping website called ReadyPipe did a deep dive on subway delays and found that the overall worst line is the A train — but the 4 train is worse during rush hour. The chart-heavy post is fascinating reading. (ReadyPipe)

- And finally, some personal news.