Today's Headlines

Today’s Headlines

Stay in touch

Sign up for our free newsletter

More from Streetsblog New York City

Deal Reached: Hochul Says ‘Sammy’s Law’ Will Pass

The bill, though imperfect, has been four years in the making.

Komanoff: A ‘Noise Tax’ Can Ground NYC Helicopters

A proposed $400 “noise tax” on “nonessential” flights is a start — and it will work.

Thursday’s Headlines: Welcome to the War on Cars, Scientific American

Our favorite story yesterday was this editorial in an unexpected place. Plus other news.

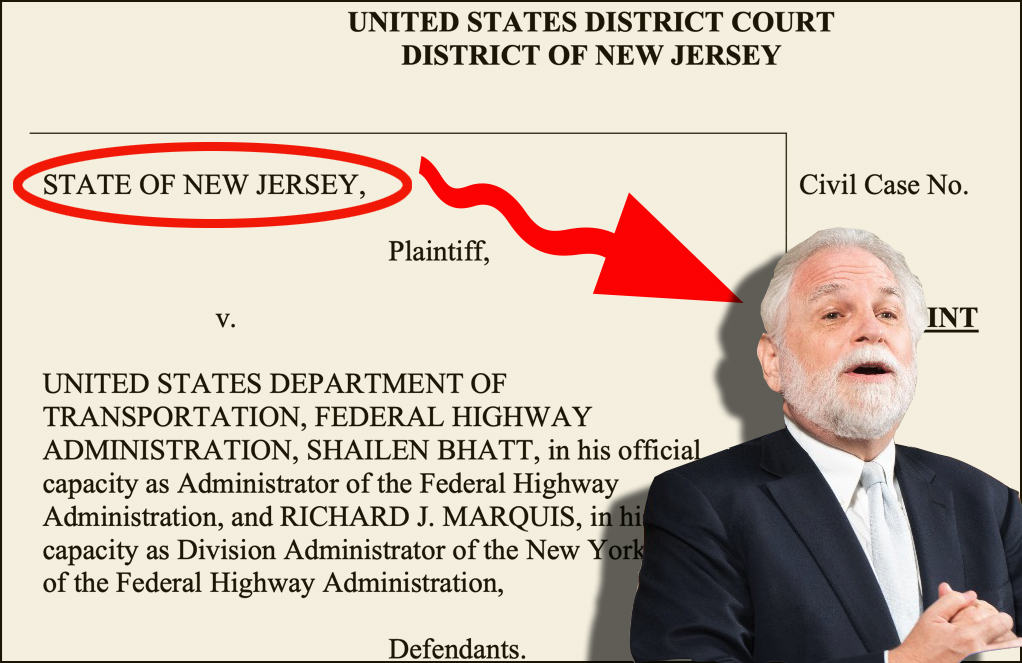

Meet the MTA Board Member and Congestion Pricing Foe Who Uses Bridges and Tunnels For Free Every Day

Mack drives over the transportation authority's bridges and tunnels thanks to a rare perk of which he is the primary beneficent.

Randy Mastro Aspires to Join Mayor’s Inner Circle of Congestion Pricing Foes

The mayor's reported pick to run the city Law Department is former deputy mayor under Rudy Giuliani and notorious foe of bike lanes and congestion pricing.