Transit Funding

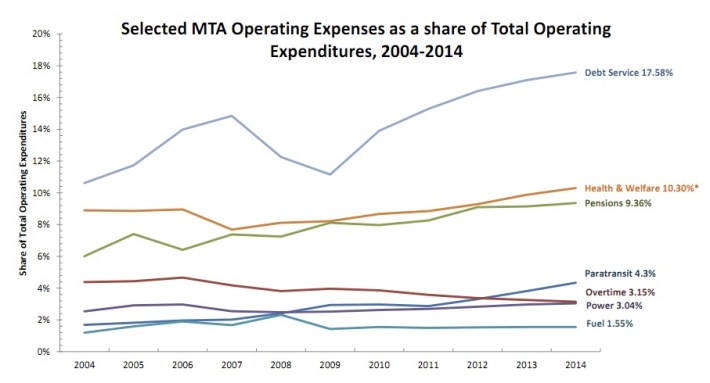

Fitch Downgrades MTA Debt — Interest Payments May Eat More of Your Fare

Stay in touch

Sign up for our free newsletter

More from Streetsblog New York City

Tuesday’s Headlines: Valley of Political Death Edition

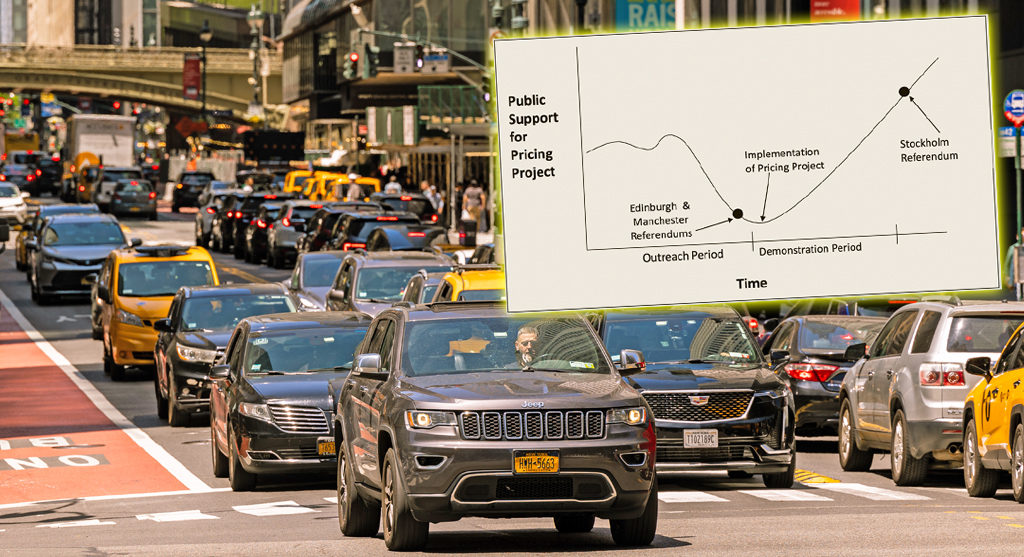

Did you see the new poll showing congestion pricing is really unpopular? Ignore it! Good times are coming. Plus other news in today's headlines.

Open Streets Groups Warn of Extra Red Tape to Run Events

Two weeks notice for hopscotch or a yoga class?

Monday’s Headlines: A Federal Case over Parking Edition

We're flicking our bicycle bell over a big scoop last week that no one picked up on...yet. Plus other news.

Hochul, Legislators Reach Toll Evasion Crackdown Deal

Higher fines for covering a plate and for not paying tolls are part of the budget deal inked on Saturday.

Behind the Scenes: How Gov. Hochul Got ‘Sammy’s Law’ Over the Finish Line

Opponents didn't want to put their name on a no vote for the life-saving measure.