Suburban State Senate Candidates Campaign Against MTA Payroll Tax

6:04 PM EDT on November 1, 2010

With the MTA at least $9 billion short on funding for its five-year capital plan, New Yorkers who ride buses and subways should be counting on legislators to secure a new revenue stream for transit. But after tomorrow's elections, the first transit fight in Albany may not be over new revenue at all. Repealing the payroll mobility tax, passed along strict party lines as part of the 2009 MTA funding package, is a top priority for many suburban State Senate candidates, especially Republicans.

Senate Minority Leader Dean Skelos is a fierce opponent of the payroll tax and could gain control of his chamber if the GOP picks up just two additional seats. Gubernatorial favorite Andrew Cuomo hasn't had anything good to say about the payroll tax either. That means over $1.1 billion a year in transit funding is potentially on the chopping block.

Perhaps the fiercest fight over the payroll tax is happening in southern Suffolk County, where incumbent Brian X. Foley is defending his seat against Republican Lee Zeldin. Zeldin has made the payroll tax perhaps the number one issue in the campaign, going so far as to call his opponent "Brian 'MTA Tax' Foley" in press releases on subjects unconnected to transit or tax policy.

Zeldin has called for eliminating the payroll tax. "Entities paying the tax have been forced to lay off employees, cut payroll and watch their profits shrink," says Zeldin's campaign website. "We must also reform the MTA’s pattern of wasteful spending and mismanagement instead of supporting bailouts like the Foley Payroll Tax."

Foley, in contrast, is pushing a compromise where the payroll tax is reduced by one-third in Nassau and Westchester Counties and by two-thirds in the rest of the MTA service region [PDF]. "Mr. Foley doesn't like the tax and is working to make it less burdensome to businesses," his campaign manager told the Wall Street Journal. "It was either that or let them raise fares 35 or 40%, cut service dramatically."

Foley's grudging support for the payroll tax is mirrored by a number of incumbent Democratic senators, all of whom voted for the MTA rescue package. In Westchester County, Sen. Suzi Oppenheimer said on a radio show that she "didn’t support it nor do I know anyone who likes this tax."

A spokesperson later clarified Oppenheimer's position, saying, " In 2009 the Senate was presented with only one proposal to support the MTA at a time of financial crisis and proposed draconian fare increases. At the time it passed the Senator indicated her preference for other revenue sources such as tolls on the East River bridges." The spokesperson said that Oppenheimer supports the repeal of the payroll tax.

Oppenheimer's opponent, Bob Cohen, puts "a repeal of the outrageous MTA payroll tax" as part of his platform on his website. In an interview with a Scarsdale website, Cohen said, "The MTA is a huge bureaucracy and a top-heavy organization with many six figure salaries. The legislature should not have taken away from our children’s education because this organization can’t get its act together."

The Democrats don't always offer even that kind of qualified support for transit financing, however. In the 40th Senate District, which stretches from Westchester through Putnam County and into Dutchess County, both candidates are unambiguously opposed to the payroll tax. "This MTA payroll tax is the final nail in the coffin of a state that is trending vociferously into a downward spiral," said Assembly Member Greg Ball, the Republican and self-avowed Tea Partier running for the seat. "Sheldon Silver and his legislative cronies are not leaders, they are Kamikaze pilots intent on sinking with the ship."

Ball's opponent, Mike Kaplowitz, puts it less colorfully, but the meaning is the same. "Mike will create jobs by lowering taxes on businesses and repealing the MTA tax," his website proclaims. Kaplowitz has also expressed interest in swapping the payroll tax for East River bridge tolls.

One suburban Democrat in a competitive race who hasn't run from his payroll tax vote is northern Nassau County's Craig Johnson. In a debate with his opponent, Jack Martins, Johnson said "nobody likes bailouts but the fact is is that we were facing massive fare hikes in order to prevent the bailout and that just wasn't feasible." He also blamed past legislatures for forcing the MTA to rack up the debt that is currently dragging down the agency.

In contrast, Martins has called to repeal the tax. "Craig Johnson added insult to injury as he cast the deciding vote to impose an onerous MTA payroll tax on all Nassau County businesses, schools and charities," read one e-mail that Martin sent out to his supporters. "Together, we cough up another $100 million to keep the dysfunctional and gluttonous MTA afloat — whether we ride or not."

Inside New York City limits, the payroll tax hasn't emerged as a central issue in the same way as in the outlying counties. It doesn't seem to have come up on the record in the heated race between incumbent Queens Republican Frank Padavan, who voted against the MTA rescue, and former City Council member Tony Avella.

Further south in Queens, Anthony Como has raised the issue in his campaign against incumbent Democrat Joseph Addabbo, although it hasn't been a chief concern of his. Como has promised to repeal the payroll tax and complains on his website that the legislature has provided "no 5-year highway, road and bridge plan – a key economic development initiative for Upstate and Long Island – while approving over $23.8B in new funding for the MTA." Addabbo seems to have been silent on the payroll tax since voting for it in 2009.

Of course, in three-men-in-a-room Albany, the positions of the candidates in all these competitive races can be less important than those of the party leaders. For example, Senate Minority Leader Dean Skelos has "Repealing MTA Tax" as one of his four basic positions on the front of his campaign website. (Skelos is also a long-time opponent of congestion pricing.) If his party takes over the State Senate and he continues to make repeal a top priority, he might be able to force the issue.

Andrew Cuomo, the man likely to wield the veto pen, is also on record saying that we need to "revisit" the payroll tax. Expect this to be a top battle in Albany next year.

Stay in touch

Sign up for our free newsletter

More from Streetsblog New York City

Tuesday’s Headlines: Valley of Political Death Edition

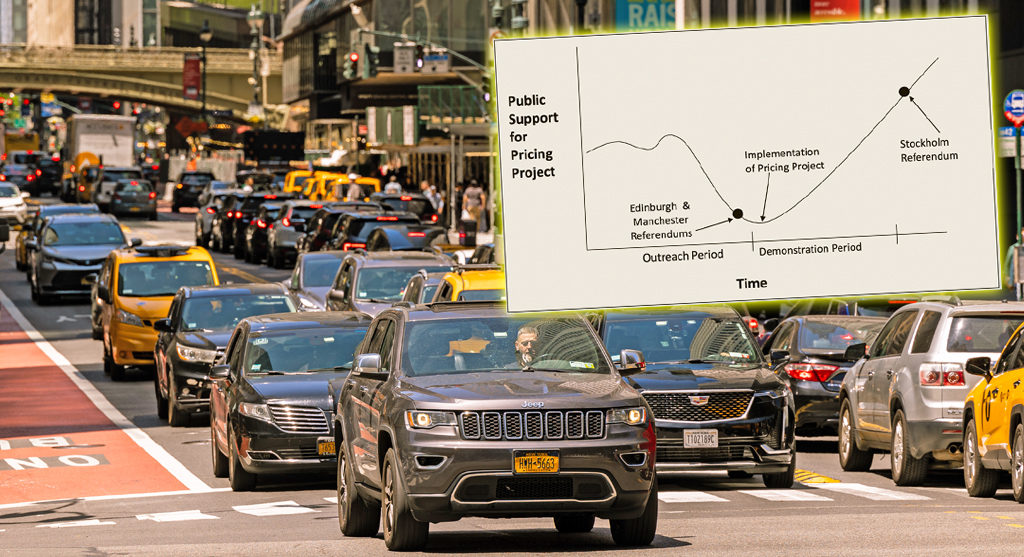

Did you see the new poll showing congestion pricing is really unpopular? Ignore it! Good times are coming. Plus other news in today's headlines.

Open Streets Groups Warn of Extra Red Tape to Run Events

Two weeks notice for hopscotch or a yoga class?

Monday’s Headlines: A Federal Case over Parking Edition

We're flicking our bicycle bell over a big scoop last week that no one picked up on...yet. Plus other news.

Hochul, Legislators Reach Toll Evasion Crackdown Deal

Higher fines for covering a plate and for not paying tolls are part of the budget deal inked on Saturday.

Behind the Scenes: How Gov. Hochul Got ‘Sammy’s Law’ Over the Finish Line

Opponents didn't want to put their name on a no vote for the life-saving measure.