MTA

The Fuse Is Still Lit on MTA Debt Bomb

Stay in touch

Sign up for our free newsletter

More from Streetsblog New York City

Brooklyn Civic Panel Can’t Agree How to Solve NYPD Sidewalk Parking

Move the illegal sidewalk parking or denounce it altogether?

Wednesday’s Headlines: Bike Lane Delay Edition

Remember the proposed sidewalk bike lane on Ocean Avenue? So do we. Plus other news in today's media digest.

Landmarks Officials OK Delivery Worker Hub Outside City Hall

The sleek new delivery hub and charging station will replace a 1980s-era newsstand that's sat empty since the pandemic.

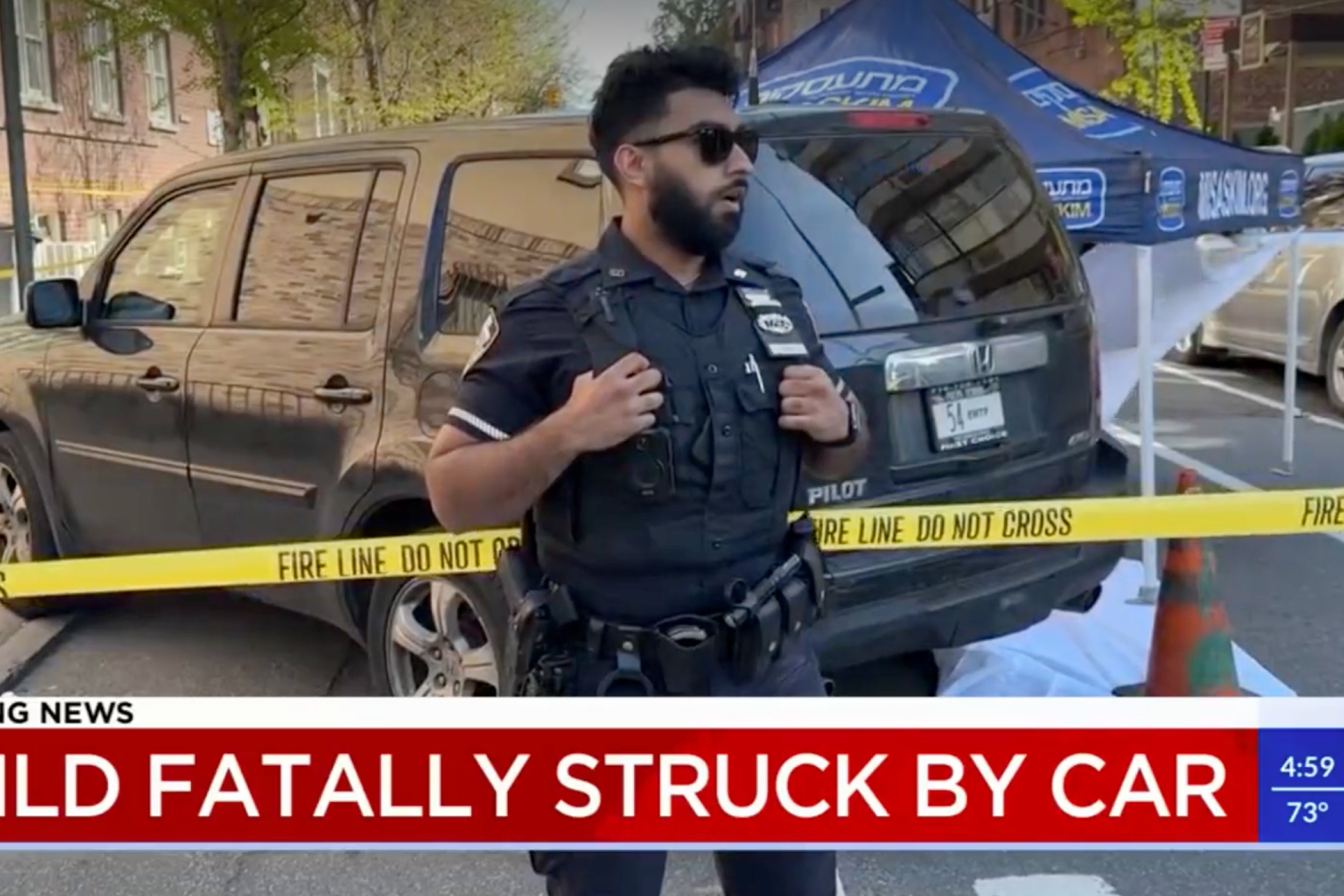

Update: Driver Charged After Killing 10-Year-Old Girl Near South Williamsburg Playground

The 62-year-old driver struck and killed the youngster at the intersection of Wallabout Street and Wythe Avenue.

Car Crashes by City Workers Cost Taxpayers $180M in Payouts Last Year: Report

A record number of victims of crashes involving city employees in city-owned cars filed claims in fiscal year 2023 — and settlements with victims have jumped 23 percent, a new report shows.