Bailout Bill Includes Bike Commuting Benefit

Stay in touch

Sign up for our free newsletter

More from Streetsblog New York City

Under Threat of Federal Suit (Again!), City Hall Promises Action on ‘Unacceptable’ Illegal Police Parking

A deputy mayor made a flat-out promise to eliminate illegal police parking that violates the Americans With Disabilities Act. But when? How? We don't know.

Wednesday’s Headlines: Four for Fifth Edition

The good news? There's a new operator for the Fifth Avenue open street. The bad news? It's four blocks, down from 15 last year. Plus other news.

MTA Plan to Run Brooklyn-Queens Train on City Streets a ‘Grave’ Mistake: Advocates

A 515-foot tunnel beneath All Faiths Cemetery would slightly increase the cost of the project in exchange for "enormous" service benefits, a new report argues.

Full Court Press by Mayor for Congestion Pricing Foe Randy Mastro

Pay no attention to that lawyer behind the curtain fighting for New Jersey, the mayor's team said on Tuesday, channeling the Wizard of Oz.

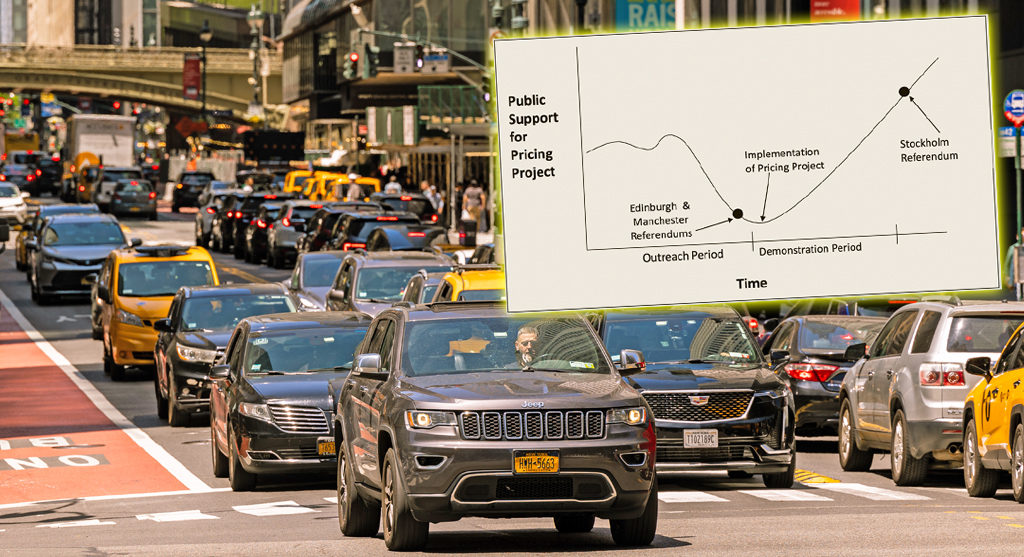

Tuesday’s Headlines: Valley of Political Death Edition

Did you see the new poll showing congestion pricing is really unpopular? Ignore it! Good times are coming. Plus other news in today's headlines.